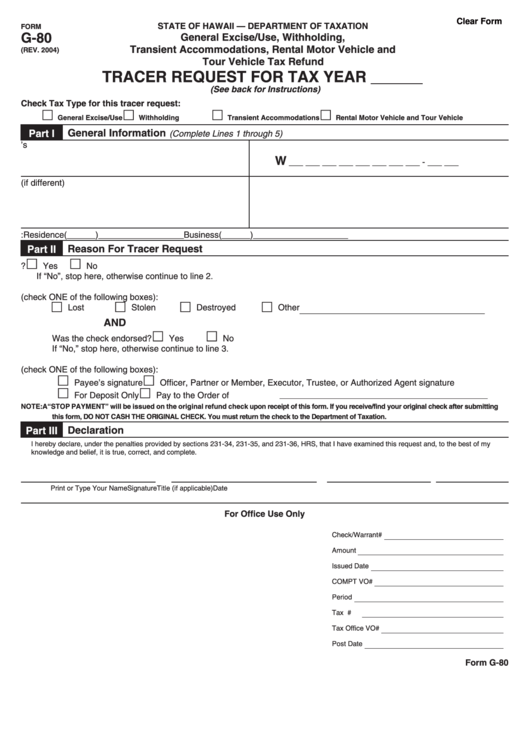

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

G-80

General Excise/Use, Withholding,

Transient Accommodations, Rental Motor Vehicle and

(REV. 2004)

Tour Vehicle Tax Refund

TRACER REQUEST FOR TAX YEAR ______

(See back for Instructions)

Check Tax Type for this tracer request:

£

£

£

£

General Excise/Use

Withholding

Transient Accommodations

Rental Motor Vehicle and Tour Vehicle

General Information

Part I

(Complete Lines 1 through 5)

1. Taxpayer’s Name

2. Hawaii Tax I.D. Number for the tax account indicated above

W

___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

3. Mailing Address on the Return

4. New Mailing Address (if different)

5. Daytime Telephone Number: Residence (______)__________________

Business (______)____________________

Reason For Tracer Request

Part II

£

£

1. Did you receive the refund check?

Yes

No

If “No”, stop here, otherwise continue to line 2.

2. The refund check was received but was (check ONE of the following boxes):

£

£

£

£

Lost

Stolen

Destroyed

Other _______________________________________

AND

£

£

Was the check endorsed?

Yes

No

If “No,” stop here, otherwise continue to line 3.

3. The refund check was endorsed with (check ONE of the following boxes):

£

£

Payee’s signature

Officer, Partner or Member, Executor, Trustee, or Authorized Agent signature

£

£

For Deposit Only

Pay to the Order of

NOTE:

A “STOP PAYMENT” will be issued on the original refund check upon receipt of this form. If you receive/find your original check after submitting

this form, DO NOT CASH THE ORIGINAL CHECK. You must return the check to the Department of Taxation.

Declaration

Part III

I hereby declare, under the penalties provided by sections 231-34, 231-35, and 231-36, HRS, that I have examined this request and, to the best of my

knowledge and belief, it is true, correct, and complete.

Print or Type Your Name

Signature

Title (if applicable)

Date

For Office Use Only

Check/Warrant#

Amount

Issued Date

COMPT VO#

Period

Tax I.D.#

Tax Office VO#

Post Date

Form G-80

1

1