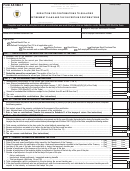

Form Income 23 - Tax Credit For Contributions To Enterprise Zone Administrators, Programs, Projects Or Organizations - 2000

ADVERTISEMENT

TAXPAYER SERVICE DIVISION

FYI – For Your Information

Tax Credit for Contributions to

Enterprise Zone Administrators,

Programs, Projects or Organizations

Under the terms of Senate Bill 96-193,

GENERAL INFORMATION

information about taxpayer contributions

For income tax years beginning on or

and their effect on Colorado income tax

after Jan. 1, 1996, any taxpayer who

liabilities may be subject to release to the

makes monetary or in-kind contributions

public [§39-30-103.5(7) C.R.S.]

to an enterprise zone administrator or to

an agent designated by the enterprise

ELIGIBLE PURPOSES

zone administrator for the purpose of

To qualify for the credit, the contribution

implementing the economic development

must be used for purposes that are

plan of the enterprise zone may claim an

directly related to job creation, job preser-

income tax credit of 25 percent of the

vation, child care programs, or assistance

value of the contribution up to a maxi-

programs for homeless persons.

mum credit of $100,000.

For income tax years beginning prior to

Child Care Programs

Jan. 1, 1996, the credit was 50 percent of

For income tax years beginning prior to

the value of the contribution. [§39-30-

Jan. 1, 1999, contributions made for the

103.5 (1) C.R.S.]

purpose of promoting child care within an

enterprise zone qualify for the credit.

Exceptions

Such contributions may be for the pur-

The 50 percent credit will be allowed for

pose of

tax years beginning on or after Jan. 1,

• establishing a child care facility in an

1996 for:

enterprise zone;

1) contributions made prior to July 1,

• establishing a fund for making grants

1997 to or for the benefit of a recipient

or loans to parents residing or

certified in writing by the zone

employed in an enterprise zone who

administrator prior to May 1, 1996 as

Colorado Department

need assistance in paying for child

of Revenue

a qualified funds recipient; or

Taxpayer Service Division

care;

1375 Sherman St.

2) contributions made prior to Jan. 1,

Denver, Colorado 80261

• the expense of training child care

2001 to or for the benefit of a recipient

providers; or

Sales Tax: (303) 232-2416

certified in writing by the zone

Withholding Tax: (303) 232-2416

administrator prior to May 1, 1996 as

Income Tax: (303) 232-2446

• establishing child care information

Severance Tax: (303) 232-2446

a qualified funds recipient in

dissemination or referral programs

Fuel Tax: (303) 205-5602

accordance with a written agreement

within a zone.

between the donor and the zone

Contributions made for promoting child

administrator executed prior to

PAGE 1 OF 4

INCOME 23 (09/00)

care for income tax years beginning on or

July 1, 1997.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4