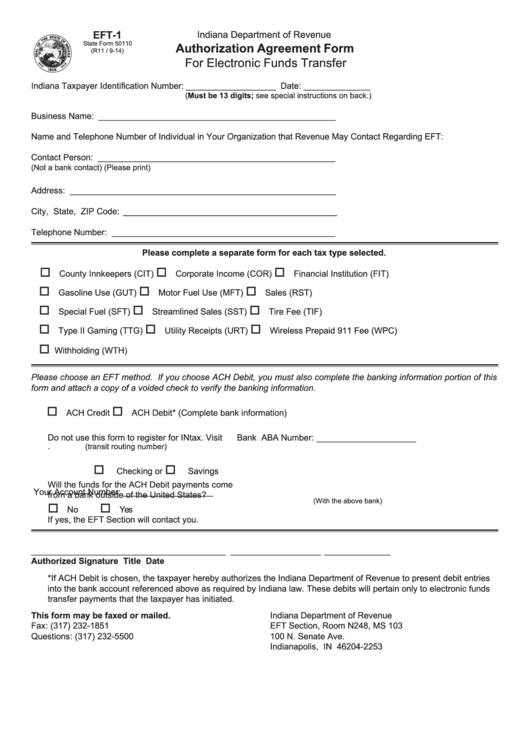

EFT-1

Indiana Department of Revenue

State Form 50110

Authorization Agreement Form

(R11 / 9-14)

For Electronic Funds Transfer

Indiana Taxpayer Identification Number: ___________________

Date: ______________

(Must be 13 digits; see special instructions on back.)

Business Name: __________________________________________________

Name and Telephone Number of Individual in Your Organization that Revenue May Contact Regarding EFT:

Contact Person: __________________________________________________

(Not a bank contact)

(Please print)

Address: ________________________________________________________

City, State, ZIP Code: _____________________________________________

Telephone Number: _______________________________________________

Please complete a separate form for each tax type selected.

o

o

o

County Innkeepers (CIT)

Corporate Income (COR)

Financial Institution (FIT)

o

o

o

Gasoline Use (GUT)

Motor Fuel Use (MFT)

Sales (RST)

o

o

o

Special Fuel (SFT)

Streamlined Sales (SST)

Tire Fee (TIF)

o

o

o

Type II Gaming (TTG)

Utility Receipts (URT)

Wireless Prepaid 911 Fee (WPC)

o

Withholding (WTH)

Please choose an EFT method. If you choose ACH Debit, you must also complete the banking information portion of this

form and attach a copy of a voided check to verify the banking information.

o

o

ACH Credit

ACH Debit* (Complete bank information)

Do not use this form to register for INtax. Visit

Bank ABA Number: _____________________

(transit routing number)

o

o

Checking

or

Savings

Will the funds for the ACH Debit payments come

Your Account Number: ___________________

from a bank outside of the United States?

(With the above bank)

o

o

No

Yes

If yes, the EFT Section will contact you.

_________________________________________

___________________

______________

Authorized Signature

Title

Date

*If ACH Debit is chosen, the taxpayer hereby authorizes the Indiana Department of Revenue to present debit entries

into the bank account referenced above as required by Indiana law. These debits will pertain only to electronic funds

transfer payments that the taxpayer has initiated.

This form may be faxed or mailed.

Indiana Department of Revenue

Fax: (317) 232-1851

EFT Section, Room N248, MS 103

Questions: (317) 232-5500

100 N. Senate Ave.

Indianapolis, IN 46204-2253

1

1