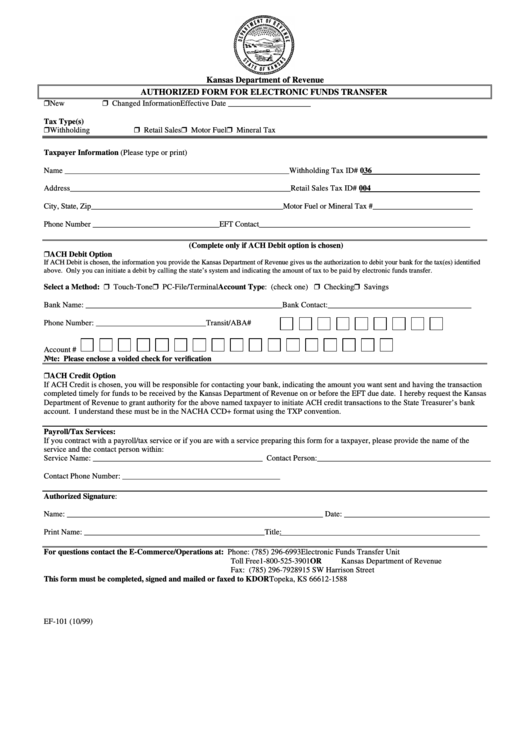

Form Ef-101 - Authorized Form For Electronic Funds Transfer

ADVERTISEMENT

Kansas Department of Revenue

AUTHORIZED FORM FOR ELECTRONIC FUNDS TRANSFER

New

Changed Information

Effective Date _____________________

Tax Type(s)

Withholding

Retail Sales

Motor Fuel

Mineral Tax

Taxpayer Information (Please type or print)

Name _________________________________________________________ Withholding Tax ID# 036

Address________________________________________________________ Retail Sales Tax ID# 004

City, State, Zip__________________________________________________ Motor Fuel or Mineral Tax #__________________________

Phone Number _________________________________

EFT Contact_______________________________________________________

(Complete only if ACH Debit option is chosen)

ACH Debit Option

If ACH Debit is chosen, the information you provide the Kansas Department of Revenue gives us the authorization to debit your bank for the tax(es) identified

above. Only you can initiate a debit by calling the state’s system and indicating the amount of tax to be paid by electronic funds transfer.

Select a Method:

Touch-Tone

PC-File/Terminal

Account Type: (check one)

Checking

Savings

Bank Name: __________________________________________________

Bank Contact:_____________________________________

Phone Number: ____________________________

Transit/ABA#

Account #

Note: Please enclose a voided check for verification

ACH Credit Option

If ACH Credit is chosen, you will be responsible for contacting your bank, indicating the amount you want sent and having the transaction

completed timely for funds to be received by the Kansas Department of Revenue on or before the EFT due date. I hereby request the Kansas

Department of Revenue to grant authority for the above named taxpayer to initiate ACH credit transactions to the State Treasurer’s bank

account. I understand these must be in the NACHA CCD+ format using the TXP convention.

Payroll/Tax Services:

If you contract with a payroll/tax service or if you are with a service preparing this form for a taxpayer, please provide the name of the

service and the contact person within:

Service Name: ___________________________________________ Contact Person:____________________________________________

Contact Phone Number: ________________________________________

Authorized Signature:

Name: _________________________________________________________________ Date: _____________________________________

Print Name: ______________________________________________Title:

For questions contact the E-Commerce/Operations at: Phone: (785) 296-6993

Electronic Funds Transfer Unit

Toll Free1-800-525-3901

OR

Kansas Department of Revenue

Fax: (785) 296-7928

915 SW Harrison Street

This form must be completed, signed and mailed or faxed to KDOR

Topeka, KS 66612-1588

EF-101 (10/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1