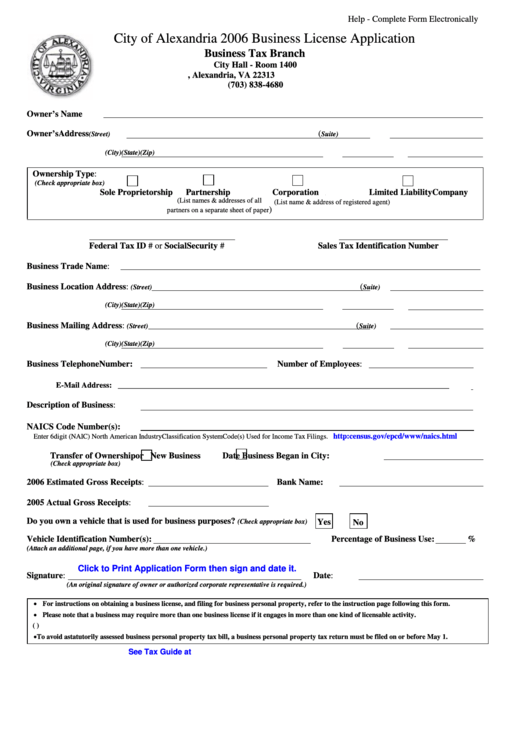

Help - Complete Form Electronically

City of Alexandria 2006 Business License Application

Business Tax Branch

City Hall - Room 1400

P.O. Box 178, Alexandria, VA 22313

(703) 838-4680

alexandriava.gov

Owner’s Name

Owner’s Address

(

(Street)

Suite)

(City)

(State)

(Zip)

Ownership Type:

(Check appropriate box)

So le P ro priet o rship

Partnership

Co rpo ra t ion

Limit ed Lia bilit y Co mpa ny

nn

n

n

Nn

(List names & addresses of all

(List name & address of registered agent)

)

partners on a separate sheet of paper

F edera l Ta x ID # o r So cia l Securit y #

Sa les Ta x Ident if ica t io n Number

Business Trade Name:

Business Location Address:

(

(Street)

Suite)

(City)

(State)

(Zip)

Business Mailing Address:

(

(Street)

Suite)

(City)

(State)

(Zip)

Business Telephone Number:

Number of Employees:

E-Mail Address: ____________________________________________________________________________________

Description of Business:

NAICS Code Number(s):

http:/ / w w w . census. g ov/ epcd/ w w w / nai cs. html

En t er 6 d i gi t (NAIC ) Nort h Ameri c a n In d u st ry C la ssi fi c a t i on Syst em C od e(s) Used for Income Ta x Fi li n gs.

Transfer of Ownership

or New Business

Date Business Began in City:

(Check appropriate box)

2006 Estimated Gross Receipts:

Bank Name:

2005 Actual Gross Receipts:

Do you own a vehicle that is used for business purposes?

(Check appropriate box)

Yes

No

Vehicle Identification Number(s):

Percentage of Business Use:

%

(Attach an additional page, if you have more than one vehicle.)

Click to Print Application Form then sign and date it.

Signature:

Date:

(An original signature of owner or authorized corporate representative is required.)

For instructions on obtaining a business license, and filing for business personal property, refer to the instruction page following this form.

Please note that a business may require more than one business license if it engages in more than one kind of licensable activity.

(e.g. A retail store that also provides a professional consulting service or a restaurant that also retails packaged food or T-shirts)

T o a vo i d a sta tuto r i l y a sse sse d busi ne ss pe r so na l pr o pe r ty ta x bi l l , a busi ne ss pe r so na l pr o pe r ty ta x r e tur n must be f i l e d o n o r be f o r e Ma y 1 .

See Tax Guide at

1

1