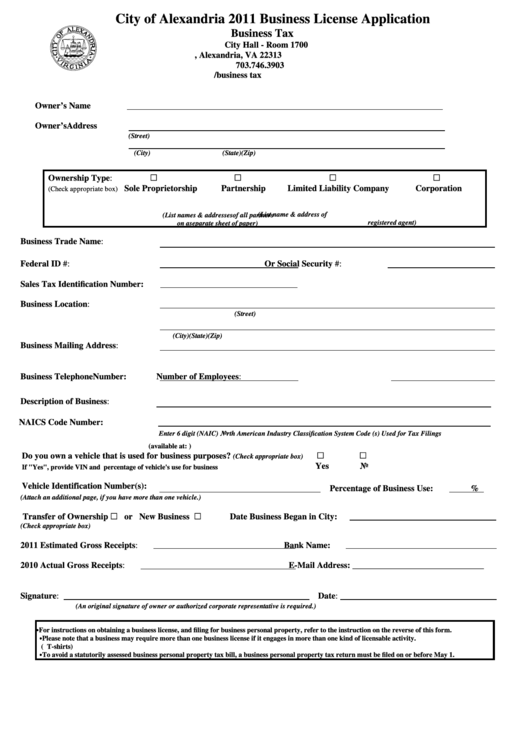

City of Alexandria 2011 Business License Application

Business Tax

City Hall - Room 1700

P.O. Box 178, Alexandria, VA 22313

703.746.3903

alexandriava.gov/business tax

Owner’s Name

Owner’s Address

(Street)

(City)

(State)

(Zip)

G

G

G

G

Ownership Type:

Sole Proprietorship

Partnership

Limited Liability Company

Corporation

(Check appropriate box)

(List name & address of

(List names & addresses of all partners

registered agent)

on a separate sheet of paper)

Business Trade Name:

Federal ID #:

Or Social Security #:

Sales Tax Identification Number:

Business Location:

(Street)

(City)

(State)

(Zip)

Business Mailing Address:

Business Telephone Number:

Number of Employees:

Description of Business:

NAICS Code Number:

Enter 6 digit (NAIC) North American Industry Classification System Code (s) Used for Tax Filings

(available at: )

G

G

Do you own a vehicle that is used for business purposes?

(Check appropriate box)

Yes

No

If "Yes", provide VIN and percentage of vehicle's use for business

Vehicle Identification Number(s):

Percentage of Business Use:

%

(Attach an additional page, if you have more than one vehicle.)

G

G

Transfer of Ownership

or New Business

Date Business Began in City:

(Check appropriate box)

2011 Estimated Gross Receipts:

Bank Name:

2010 Actual Gross Receipts:

E-Mail Address: ______________________________

Signature:

Date:

(An original signature of owner or authorized corporate representative is required.)

C For instructions on obtaining a business license, and filing for business personal property, refer to the instruction on the reverse of this form.

C Please note that a business may require more than one business license if it engages in more than one kind of licensable activity.

( e.g. A retail store that also provides a professional consulting service or a restaurant that also retails packaged food or T-shirts)

C To avoid a statutorily assessed business personal property tax bill, a business personal property tax return must be filed on or before May 1.

1

1