Form Bp - Business Privilege Tax - City Of Pittsburgh - 2006

ADVERTISEMENT

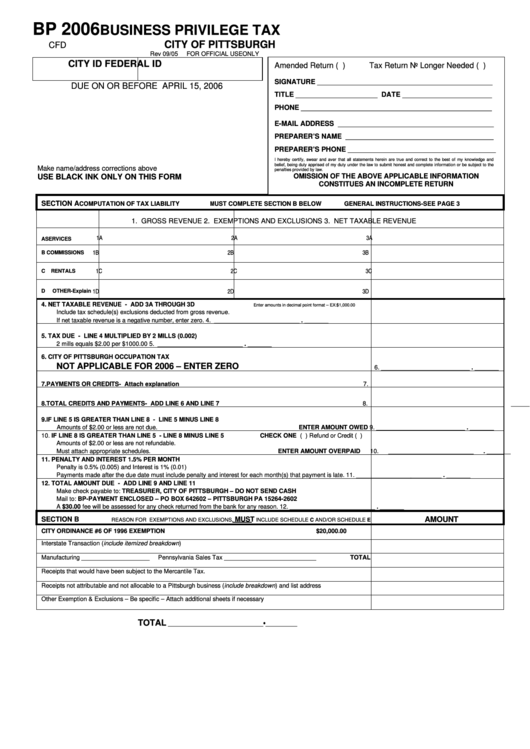

BP 2006

BUSINESS PRIVILEGE TAX

CITY OF PITTSBURGH

CFD

Rev 09/05

FOR OFFICIAL USE ONLY

CITY ID

FEDERAL ID

Amended Return ( )

Tax Return No Longer Needed ( )

SIGNATURE _____________________________________________

DUE ON OR BEFORE APRIL 15, 2006

TITLE _____________________ DATE _______________________

PHONE _________________________________________________

E-MAIL ADDRESS ________________________________________

PREPARER’S NAME ______________________________________

PREPARER’S PHONE ______________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and

belief, being duly apprised of my duty under the law to submit honest and complete information or be subject to the

Make name/address corrections above

penalties provided by law.

OMISSION OF THE ABOVE APPLICABLE INFORMATION

USE BLACK INK ONLY ON THIS FORM

CONSTITUES AN INCOMPLETE RETURN

MUST COMPLETE SECTION B BELOW

SECTION A

COMPUTATION OF TAX LIABILITY

GENERAL INSTRUCTIONS-SEE PAGE 3

1. GROSS REVENUE

2. EXEMPTIONS AND EXCLUSIONS

3. NET TAXABLE REVENUE

1A

2A

3A

A

SERVICES

1B

2B

3B

B

COMMISSIONS

1C

2C

3C

C

RENTALS

1D

2D

3D

D

OTHER-Explain

4.

NET TAXABLE REVENUE - ADD 3A THROUGH 3D

Enter amounts in decimal point format – EX:$1,000.00

Include tax schedule(s) exclusions deducted from gross revenue.

If net taxable revenue is a negative number, enter zero.

4. _________________________ . _______

5.

TAX DUE - LINE 4 MULTIPLIED BY 2 MILLS (0.002)

2 mills equals $2.00 per $1000.00

5. _________________________ . _______

6.

CITY OF PITTSBURGH OCCUPATION TAX

NOT APPLICABLE FOR 2006 – ENTER ZERO

6. __________________________ . _______

7.

PAYMENTS OR CREDITS - Attach explanation

7. __________________________ . _______

8.

TOTAL CREDITS AND PAYMENTS - ADD LINE 6 AND LINE 7

8. __________________________ . _______

9.

IF LINE 5 IS GREATER THAN LINE 8 - LINE 5 MINUS LINE 8

Amounts of $2.00 or less are not due.

ENTER AMOUNT OWED

9. __________________________ . _______

10.

IF LINE 8 IS GREATER THAN LINE 5 - LINE 8 MINUS LINE 5

CHECK ONE ( ) Refund or Credit ( )

Amounts of $2.00 or less are not refundable.

Must attach appropriate schedules.

ENTER AMOUNT OVERPAID

10. _________________________ . _______

11.

PENALTY AND INTEREST 1.5% PER MONTH

Penalty is 0.5% (0.005) and Interest is 1% (0.01)

Payments made after the due date must include penalty and interest for each month(s) that payment is late.

11. _________________________ . _______

12.

TOTAL AMOUNT DUE - ADD LINE 9 AND LINE 11

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Mail to: BP-PAYMENT ENCLOSED – PO BOX 642602 – PITTSBURGH PA 15264-2602

A $30.00 fee will be assessed for any check returned from the bank for any reason.

12. _________________________ . _______

SECTION B

MUST

AMOUNT

REASON FOR EXEMPTIONS AND EXCLUSIONS,

INCLUDE SCHEDULE C AND/OR SCHEDULE E

CITY ORDINANCE #6 OF 1996 EXEMPTION

$20,000.00

Interstate Transaction (include itemized breakdown)

Manufacturing ____________________

Pennsylvania Sales Tax ___________________________

TOTAL

Receipts that would have been subject to the Mercantile Tax.

Receipts not attributable and not allocable to a Pittsburgh business (include breakdown) and list address

Other Exemption & Exclusions – Be specific – Attach additional sheets if necessary

TOTAL

______________________________•__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2