Form Bp - Business Privilege Tax - City Of Pittsburgh - 2002

ADVERTISEMENT

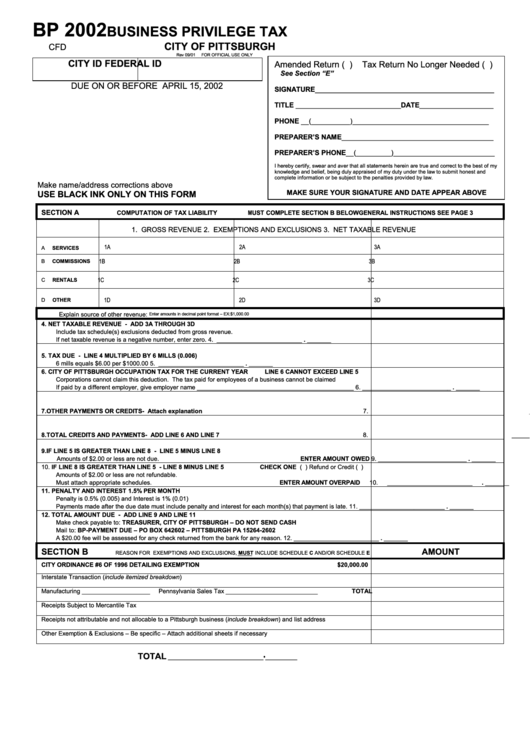

BP 2002

BUSINESS PRIVILEGE TAX

CITY OF PITTSBURGH

CFD

Rev 09/01

FOR OFFICIAL USE ONLY

CITY ID

FEDERAL ID

Amended Return ( )

Tax Return No Longer Needed ( )

See Section “E”

DUE ON OR BEFORE APRIL 15, 2002

SIGNATURE______________________________________________

TITLE ___________________________DATE___________________

PHONE __(__________)___________________________________

PREPARER’S NAME_______________________________________

PREPARER’S PHONE__(_________)__________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my

knowledge and belief, being duly appraised of my duty under the law to submit honest and

complete information or be subject to the penalties provided by law.

Make name/address corrections above

MAKE SURE YOUR SIGNATURE AND DATE APPEAR ABOVE

USE BLACK INK ONLY ON THIS FORM

SECTION A

MUST COMPLETE SECTION B BELOW

COMPUTATION OF TAX LIABILITY

GENERAL INSTRUCTIONS SEE PAGE 3

1. GROSS REVENUE

2. EXEMPTIONS AND EXCLUSIONS

3. NET TAXABLE REVENUE

1A

2A

3A

A

SERVICES

1B

2B

3B

B

COMMISSIONS

1C

2C

3C

C

RENTALS

1D

2D

3D

D

OTHER

Explain source of other revenue:

Enter amounts in decimal point format – EX:$1,000.00

4.

NET TAXABLE REVENUE - ADD 3A THROUGH 3D

Include tax schedule(s) exclusions deducted from gross revenue.

If net taxable revenue is a negative number, enter zero.

4. _________________________ . _______

5.

TAX DUE - LINE 4 MULTIPLIED BY 6 MILLS (0.006)

6 mills equals $6.00 per $1000.00

5. _________________________ . _______

6.

CITY OF PITTSBURGH OCCUPATION TAX FOR THE CURRENT YEAR

LINE 6 CANNOT EXCEED LINE 5

Corporations cannot claim this deduction. The tax paid for employees of a business cannot be claimed

If paid by a different employer, give employer name ______________________________________________

6. __________________________ . _______

7.

OTHER PAYMENTS OR CREDITS - Attach explanation

7. __________________________ . _______

8.

TOTAL CREDITS AND PAYMENTS - ADD LINE 6 AND LINE 7

8. __________________________ . _______

9.

IF LINE 5 IS GREATER THAN LINE 8 - LINE 5 MINUS LINE 8

Amounts of $2.00 or less are not due.

ENTER AMOUNT OWED

9. __________________________ . _______

10.

IF LINE 8 IS GREATER THAN LINE 5 - LINE 8 MINUS LINE 5

CHECK ONE ( ) Refund or Credit ( )

Amounts of $2.00 or less are not refundable.

Must attach appropriate schedules.

ENTER AMOUNT OVERPAID

10. _________________________ . _______

11.

PENALTY AND INTEREST 1.5% PER MONTH

Penalty is 0.5% (0.005) and Interest is 1% (0.01)

Payments made after the due date must include penalty and interest for each month(s) that payment is late.

11. _________________________ . _______

12.

TOTAL AMOUNT DUE - ADD LINE 9 AND LINE 11

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Mail to: BP-PAYMENT DUE – PO BOX 642602 – PITTSBURGH PA 15264-2602

A $20.00 fee will be assessed for any check returned from the bank for any reason.

12. _________________________ . _______

SECTION B

AMOUNT

REASON FOR EXEMPTIONS AND EXCLUSIONS, MUST INCLUDE SCHEDULE C AND/OR SCHEDULE E

CITY ORDINANCE #6 OF 1996 DETAILING EXEMPTION

$20,000.00

Interstate Transaction (include itemized breakdown)

Manufacturing ____________________

Pennsylvania Sales Tax ___________________________

TOTAL

Receipts Subject to Mercantile Tax

Receipts not attributable and not allocable to a Pittsburgh business (include breakdown) and list address

Other Exemption & Exclusions – Be specific – Attach additional sheets if necessary

TOTAL

______________________________•__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4