629, Page 2

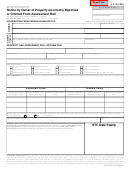

TAX RATE INFORMATION (To be completed by the assessor)

If this notice is for either of the tax years immediately preceding the current year, the assessor shall list for each year the total

tax rate levied in the city or township in which the property is located. The total annual tax rate levied must include the total

village tax rate, if applicable. The listing must reflect any millage reduction due to the Principal Residence Exemption, the

Qualified Agricultural Exemption, the Qualified Forest Exemption, the Industrial Facilities Exemption, the Commercial Property

Exemption or the Industrial Personal Property Exemption. If this notice is for omitted real property upon which "millage rate"

special assessments were levied, list those rates separately below. Do not include special assessments levied in specific dollar

amounts.

Year Covered

SUMMER

WINTER

Total Annual

by Notice

Total Tax Rate Levied

Total Tax Rate Levied

Tax Rate Levied

SPECIAL ASSESSMENT RATES. Complete lines below for special assessment millage rates only.

Year Covered

SUMMER

WINTER

Total Annual

by Notice

Special Assessment Rate Levied

Special Assessment Rate Levied

Special Assessment Rate Levied

Additional comments or explanation by Assessor. Attach additional pages if necessary:

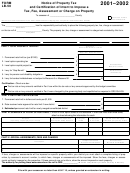

ASSESSOR'S CONCURRENCE OR DISAGREEMENT WITH THIS REQUEST

This section must be completed by the assessor.

I CONCUR with this request for corrected Assessed Value and/or Taxable Value.

I DO NOT CONCUR with this request for corrected Assessed Value and/or Taxable Value. (The assessor who

checks this box must submit to the State Tax Commission an explanation of the reason for not concurring).

Name of Assessor

Title

Assessor Certificate Number

Address

Assessor Email Address

Assessor Signature

Date

Telephone Number

OWNER'S CONCURRENCE OR DISAGREEMENT WITH THIS REQUEST

This section must be completed by the property owner.

I AGREE with this request for corrected Assessed Value and/or Taxable Value.

I DO NOT CONCUR with this request for corrected Assessed Value and/or Taxable Value. (Theowner who

checks this box must submit to the State Tax Commission an explanation of the reason for not concurring).

Did the property covered by this notice change ownership during the time period starting with the earliest year for which a

change is being requested up to the present?

Yes

No

If yes, give date:

Signature of Property Owner

Date

Telephone Number

Return this completed form to:

Property Owner Email Address

State Tax Commission

Michigan Department of Treasury

P.O. Box 30471

Lansing, MI 48909-7971

1

1 2

2