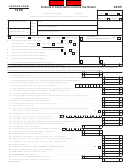

Form 725 - Individually Owned Corporation Income Tax Return - 2005 Page 2

ADVERTISEMENT

Form 725 (2005)

Page 2

SCHEDULE Q—LIMITED LIABILITY COMPANY QUESTIONNAIRE

IMPORTANT: Questions 1—10 must be completed by the

Was the limited liability company doing business in Kentucky,

limited liability company.

other than the interest held in a general partnership doing

business in Kentucky?

Yes

No

1. Single member's (owner) name, address and Social Security

number or federal I.D. number

6. Are related party costs made to related members as defined

in KRS 141.205(1)(l) included in this return?

Yes

No. If

yes, list name, federal I.D. and/or Kentucky corporation

account number of the individual or entity.

2. List the following Kentucky account numbers. Enter N/A for

any number not applicable.

Employer Withholding

7. Was this return prepared on: (a)

cash basis, (b)

accrual

Sales and Use Tax Permit

basis, (c)

other

Consumer Use Tax

Unemployment Insurance

8. Is the limited liability company a public service corporation

Coal Severance and/or

subject to taxation under KRS 136.120?

Yes

No

Processing Tax

9. Did the limited liability company file a Kentucky tangible per-

3. If a foreign limited liability company, enter the date qualified

sonal property tax return for January 1, 2006?

Yes

No

__ __

__

/ __ __ / __

to do business in Kentucky.

4. The limited liability company’s books are in care of: (name

and address)

10. Is the corporation currently under audit by the Internal

Revenue Service?

Yes

No. If yes, enter years under

audit

If the Internal Revenue Service has made final and

unappealable adjustments to the limited liability company’s

5. Is the limited liability company a partner in a general part-

taxable income which have not been reported to this

nership doing business in Kentucky?

Yes

No

department, check here

and file Form 740X, Amended

If yes, list name, federal I.D. and Kentucky account number

Kentucky Individual Income Tax Return, or Form 740-XP,

of the general partnership(s).

Amended Kentucky Individual Income Tax Return for Tax

Years 2002, 2003, 2004, whichever is applicable, for each

year adjusted and attach a copy of the final determination.

I, the undersigned, declare under the penalties of perjury, that I have examined these returns, including all accompanying schedules and

statements, and to the best of my knowledge and belief, they are true, correct and complete.

✍

Signature of member (owner)

Identification number of member (owner)

Date

Typed or printed name of preparer other than taxpayer

Identification number of preparer

Date

May the Department of

Revenue discuss this return

with the preparer?

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2