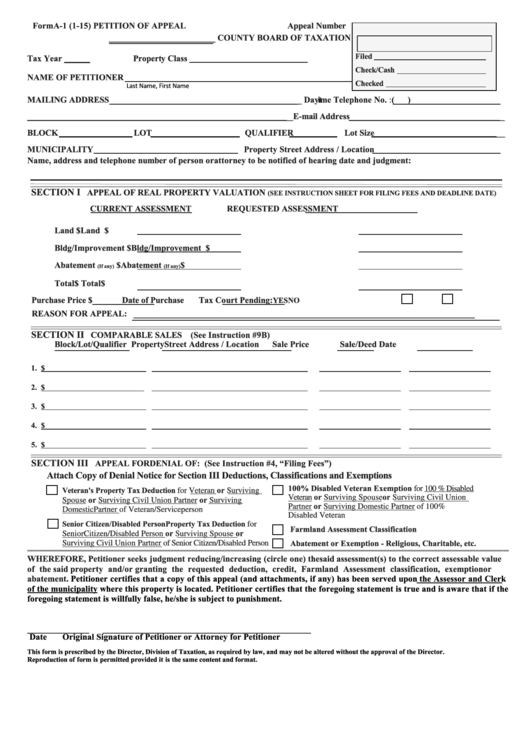

Form A-1 (1-15)

PETITION OF APPEAL

Appeal Number

________________________ COUNTY BOARD OF TAXATION

Filed

Tax Year ______

Property Class

Check/Cash

NAME OF PETITIONER

Checked

Last Name, First Name

MAILING ADDRESS ___________________________________________ Daytime Telephone No. : (

)

____________________________________________________________ E-mail Address ___________________________________

BLOCK

LOT

QUALIFIER

Lot Size _____________________________

MUNICIPALITY

Property Street Address / Location

Name, address and telephone number of person or attorney to be notified of hearing date and judgment:

SECTION I

APPEAL OF REAL PROPERTY VALUATION

(SEE INSTRUCTION SHEET FOR FILING FEES AND DEADLINE DATE)

CURRENT ASSESSMENT

REQUESTED ASSESSMENT

Land

$

Land

$

Bldg/Improvement $

Bldg/Improvement $

Abatement

$

Abatement

$

(If any)

(If any)

Total

$

Total

$

Purchase Price $

Date of Purchase

Tax Court Pending:

YES

NO

REASON FOR APPEAL: ___________________________________________________________

__________________

SECTION II

COMPARABLE SALES (See Instruction #9B)

Block/Lot/Qualifier

Property Street Address / Location

Sale Price

Sale/Deed Date

1.

$

2.

$

3.

$

4.

$

5.

$

SECTION III

APPEAL FOR DENIAL OF: (See Instruction #4, “Filing Fees”)

Attach Copy of Denial Notice for Section III Deductions, Classifications and Exemptions

100% Disabled Veteran Exemption for 100 % Disabled

for Veteran or Surviving

Veteran's Property Tax Deduction

Veteran or Surviving Spouse or Surviving Civil Union

Spouse or Surviving Civil Union Partner or Surviving

Partner or Surviving Domestic Partner of 100%

Domestic Partner of Veteran/Serviceperson

Disabled Veteran

Senior Citizen/Disabled Person Property Tax Deduction

for

Farmland Assessment Classification

Senior Citizen/Disabled Person or Surviving Spouse or

Abatement or Exemption - Religious, Charitable, etc.

Surviving Civil Union Partner of Senior Citizen/Disabled Person

=================================================================================================================================================================

WHEREFORE, Petitioner seeks judgment reducing/increasing (circle one) the said assessment(s) to the correct assessable value

of the said property and/or granting the requested deduction, credit, Farmland Assessment classification, exemption or

abatement. Petitioner certifies that a copy of this appeal (and attachments, if any) has been served upon the Assessor and Clerk

of the municipality where this property is located. Petitioner certifies that the foregoing statement is true and is aware that if the

foregoing statement is willfully false, he/she is subject to punishment.

______________

_______________________________________________

Date

Original Signature of Petitioner or Attorney for Petitioner

This form is prescribed by the Director, Division of Taxation, as required by law, and may not be altered without the approval of the Director.

Reproduction of form is permitted provided it is the same content and format.

1

1 2

2 3

3