OMB No. 1513-0078 (12/31/2008)

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

APPLICATION FOR A PERMIT AS A MANUFACTURER OF TOBACCO

PRODUCTS OR AN EXPORT WAREHOUSE PROPRIETOR

GENERAL INSTRUCTIONS

A. Why do I need this form? If you want a permit to manufacture tobacco products or to operate an export warehouse under Chapter 52 of Title 26

of the United States Code (Internal Revenue Code), complete and file this form. Applying for this permit does not authorize you to operate

contrary to any Federal, State, or local laws.

B. How do I file this form? Send this form to the Director, National Revenue Center, 550 Main St, Ste 8002, Cincinnati, OH 45202-5215. We

recommend that you keep a copy of what you send.

C. What are tobacco products? Cigars, cigarettes, smokeless tobacco, pipe tobacco, and roll-your-own tobacco.

D. What is an export warehouse? A bonded internal revenue warehouse that stores tobacco products and cigarette papers and tubes on which

tax has not been paid and that will be shipped to a foreign country, Puerto Rico, the Virgin Islands, or a United States possession, or shipped for

consumption beyond the jurisdiction of the internal revenue laws of the United States.

E. Can I reference information that TTB already has on file? Yes, if you include:

(1) The name and address on the TTB form or the TTB permit number;

(2) The TTB form and item number; and

(3) The date that the TTB form was signed.

F. What if there is not enough space for my information? State that you have attached a separate sheet in the item number on this form.

G. When I attach information to this form, should I note it? Note any attachments to its item number and the TTB form number 5200.3.

INSTRUCTIONS FOR ITEMS ON THIS FORM

H. Item 3.

What is my legal name?

Your legal name is:

Your business is a:

Sole Proprietorship

Your full name.

Partnership

The name of each partner, or the name of the partnership as filed with a State or

local government.

Corporation, association, limited liability company, or other

The name as stated on your documents filed with the State or local government.

business organization

I. Item 4.

What is my employer identification number? This is the nine-digit code that the Internal Revenue Service (IRS) assigns to your

business. If you do not have an employer identification number, you must file an IRS Form SS-4. You may get this form from the Internal

Revenue Service.

J. Item 5.

What is a trade name? In general, a trade name is used to identify your business that is not its legal name. For example, your

legal name may be ABC Corporation, but you use ABC Tobacco Products in your business operations. Business operations include any name

with which you identify your business on invoices or letterhead. Also, business operations include a name that identifies your business on

packages of tobacco products or cigarette papers and tubes.

K. Item 6.

Am I required to have a trade name certificate? Your State, county, or municipal authority may require a trade name certificate to

operate your business under a trade name. If your State, county, or municipal authority does not require a trade name certificate, state this fact

in item 6.

L. Item 8.

What must I include in my description? State the number, street, city, and state, of the location of your factory or export warehouse.

a.

b.

When do I need a diagram?

(1)

Your factory or export warehouse is more than one building and each building cannot be identified by a separate street address.

Identify each building by a letter, number, or similar designation.

(2)

Your factory or export warehouse uses only a part of a building. Show the floor and room(s) in the building.

(3)

Your factory adjoins a retail store. Show any doors or other openings between the factory and the retail store.

c.

Use of factory. Unless you have the authority from a TTB regulation or a letter written to you from an appropriate TTB officer, you cannot

use a factory for purposes other than those associated with the manufacture of tobacco products.

d.

Use of export warehouse. Unless you have the authority from a TTB regulation or a letter written to you from an appropriate TTB officer,

you cannot use an export warehouse for other than the storage of tobacco products or cigarette papers or tubes.

TTB F 5200.3 (10/2006)

1

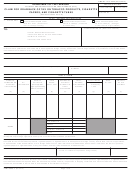

1 2

2 3

3 4

4 5

5 6

6