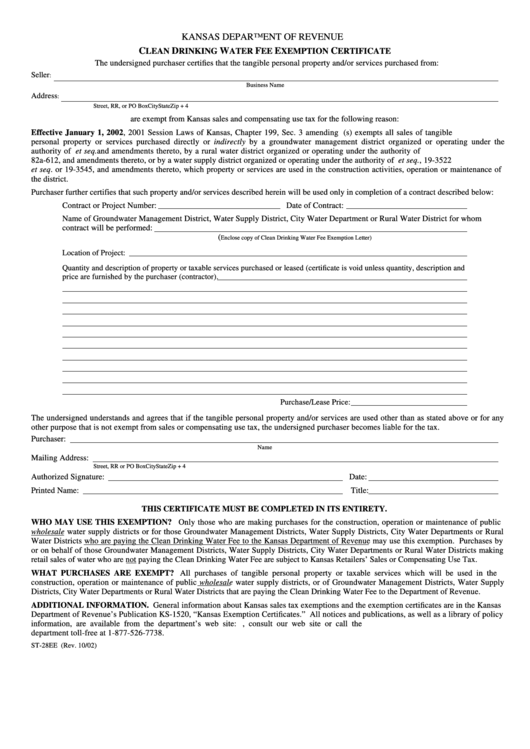

Form St-28ee - Clean Drinking Water Fee Exemption Certificate Form - Kansas Department Of Revenue

ADVERTISEMENT

KANSAS DEPARTMENT OF REVENUE

C

D

W

F

E

C

LEAN

RINKING

ATER

EE

XEMPTION

ERTIFICATE

The undersigned purchaser certifies that the tangible personal property and/or services purchased from:

Seller

:

Business Name

Address

:

Street, RR, or PO Box

City

State

Zip + 4

are exempt from Kansas sales and compensating use tax for the following reason:

Effective January 1, 2002, 2001 Session Laws of Kansas, Chapter 199, Sec. 3 amending K.S.A. 79-3606(s) exempts all sales of tangible

personal property or services purchased directly or indirectly by a groundwater management district organized or operating under the

authority of K.S.A. 82a-1020 et seq. and amendments thereto, by a rural water district organized or operating under the authority of K.S.A.

82a-612, and amendments thereto, or by a water supply district organized or operating under the authority of K.S.A. 19-3501 et seq., 19-3522

et seq. or 19-3545, and amendments thereto, which property or services are used in the construction activities, operation or maintenance of

the district.

Purchaser further certifies that such property and/or services described herein will be used only in completion of a contract described below:

Contract or Project Number:

Date of Contract:

Name of Groundwater Management District, Water Supply District, City Water Department or Rural Water District for whom

contract will be performed:

(

Enclose copy of Clean Drinking Water Fee Exemption Letter)

Location of Project:

Quantity and description of property or taxable services purchased or leased (certificate is void unless quantity, description and

price are furnished by the purchaser (contractor).

Purchase/Lease Price:

The undersigned understands and agrees that if the tangible personal property and/or services are used other than as stated above or for any

other purpose that is not exempt from sales or compensating use tax, the undersigned purchaser becomes liable for the tax.

Purchaser:

Name

Mailing Address:

Street, RR or PO Box

City

State

Zip + 4

Authorized Signature:

Date:

Printed Name:

Title:

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS EXEMPTION? Only those who are making purchases for the construction, operation or maintenance of public

wholesale water supply districts or for those Groundwater Management Districts, Water Supply Districts, City Water Departments or Rural

Water Districts who are paying the Clean Drinking Water Fee to the Kansas Department of Revenue may use this exemption. Purchases by

or on behalf of those Groundwater Management Districts, Water Supply Districts, City Water Departments or Rural Water Districts making

retail sales of water who are not paying the Clean Drinking Water Fee are subject to Kansas Retailers’ Sales or Compensating Use Tax.

WHAT PURCHASES ARE EXEMPT? All purchases of tangible personal property or taxable services which will be used in the

construction, operation or maintenance of public wholesale water supply districts, or of Groundwater Management Districts, Water Supply

Districts, City Water Departments or Rural Water Districts that are paying the Clean Drinking Water Fee to the Department of Revenue.

ADDITIONAL INFORMATION. General information about Kansas sales tax exemptions and the exemption certificates are in the Kansas

Department of Revenue’s Publication KS-1520, “Kansas Exemption Certificates.” All notices and publications, as well as a library of policy

information, are available from the department’s web site: For tax assistance, consult our web site or call the

department toll-free at 1-877-526-7738.

ST-28EE (Rev. 10/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1