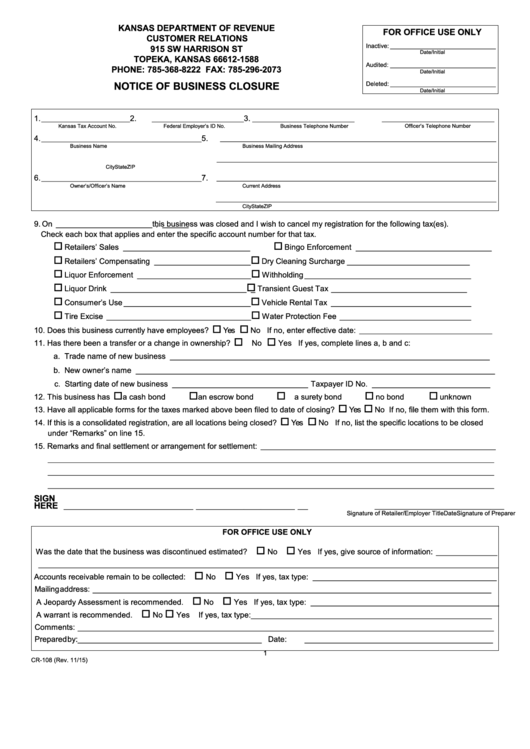

KANSAS DEPARTMENT OF REVENUE

FOR OFFICE USE ONLY

CUSTOMER RELATIONS

Inactive: _______________________________

915 SW HARRISON ST

Date/Initial

TOPEKA, KANSAS 66612-1588

Audited: _______________________________

PHONE: 785-368-8222 FAX: 785-296-2073

Date/Initial

NOTICE OF BUSINESS CLOSURE

Deleted: _______________________________

Date/Initial

1.

2.

3.

__________________________

___________________________

______________________________

_________________________________

Kansas Tax Account No.

Federal Employer’s ID No.

Business Telephone Number

Officer’s Telephone Number

4.

5.

_______________________________________________

_________________________________________________________________________________

Business Name

Business Mailing Address

_________________________________________

_______________________

________________________________

City

State

ZIP

6.

7.

_______________________________________________

__________________________________________________________________________________

Owner’s/Officer’s Name

Current Address

________________________________________________________________________________________________

City

State

ZIP

9. On ______________________

, ______

this business was closed and I wish to cancel my registration for the following tax(es).

Check each box that applies and enter the specific account number for that tax.

Retailers’ Sales _____________________________

Bingo Enforcement _______________________________

Retailers’ Compensating ______________________

Dry Cleaning Surcharge ____________________________

Liquor Enforcement __________________________

Withholding ______________________________________

Liquor Drink _______________________________

_

Transient Guest Tax _______________________________

Consumer’s Use _____________________________

Vehicle Rental Tax ________________________________

Tire Excise _________________________________

Water Protection Fee ______________________________

10. Does this business currently have employees?

Yes

No If no, enter effective date:

_______________________________________

11. Has there been a transfer or a change in ownership?

N o

Yes If yes, complete lines a, b and c:

a. Trade name of new business _________________________________________________________________________

b. New owner’s name __________________________________________________________________________________

c. Starting date of new business _______________________________ Taxpayer ID No. ___________________________

12. This business has

a cash bond

an escrow bond

a surety bond

no bond

unknown

13. Have all applicable forms for the taxes marked above been filed to date of closing?

Yes

No If no, file them with this form.

14. If this is a consolidated registration, are all locations being closed?

Yes

No If no, list the specific locations to be closed

under “Remarks” on line 15.

15. Remarks and final settlement or arrangement for settlement:

_____________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

SIGN

HERE

______________________________________

______________

__________

___

_____

____

__________________________________

Signature of Retailer/Employer

Title

Date

Signature of Preparer

FOR OFFICE USE ONLY

Was the date that the business was discontinued estimated?

No

Yes If yes, give source of information: ______________

_________________________________________________________________________________________________________

Accounts receivable remain to be collected:

No

Yes If yes, tax type: __________________________________________

Mailing address: ___________________________________________________________________________________________

A Jeopardy Assessment is recommended.

No

Yes If yes, tax type: ___________________________________________

A warrant is recommended.

No

Yes

If yes, tax type: _______________________________________________________

Comments: _______________________________________________________________________________________________

Prepared by:__________________________________________

Date: ___________________________________________

1

CR-108 (Rev. 11/15)

1

1