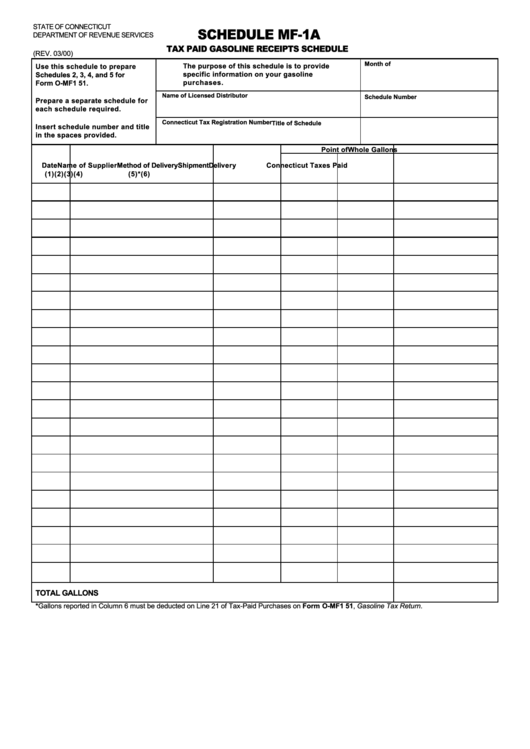

Schedule Mf-1a - Tax Paid Gasoline Receipts Schedule - State Of Connecticut - Department Of Revenue Services

ADVERTISEMENT

STATE OF CONNECTICUT

SCHEDULE MF-1A

DEPARTMENT OF REVENUE SERVICES

TAX PAID GASOLINE RECEIPTS SCHEDULE

(REV. 03/00)

Month of

The purpose of this schedule is to provide

Use this schedule to prepare

specific information on your gasoline

Schedules 2, 3, 4, and 5 for

purchases.

Form O-MF1 51.

Name of Licensed Distributor

Schedule Number

Prepare a separate schedule for

each schedule required.

Connecticut Tax Registration Number

Title of Schedule

Insert schedule number and title

in the spaces provided.

Point of

Whole Gallons

Date

Name of Supplier

Method of Delivery

Shipment

Delivery

Connecticut Taxes Paid

(1)

(2)

(3)

(4)

(5)

*(6)

TOTAL GALLONS

*Gallons reported in Column 6 must be deducted on Line 21 of Tax-Paid Purchases on Form O-MF1 51, Gasoline Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1