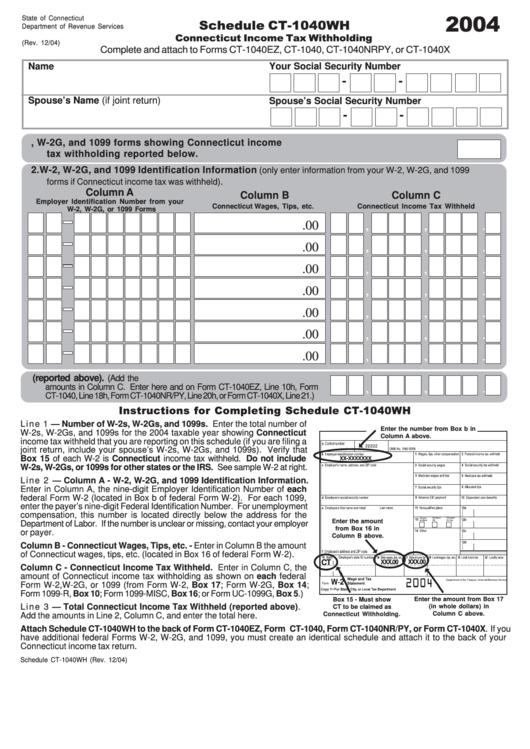

Schedule Ct-1040wh - Connecticut Income Tax Withholding Spread Sheet - State Of Connecticut Department Of Revenue Services - 2004

ADVERTISEMENT

2004

State of Connecticut

Schedule CT-1040WH

Department of Revenue Services

Connecticut Income Tax Withholding

(Rev. 12/04)

Complete and attach to Forms CT-1040EZ, CT-1040, CT-1040NRPY, or CT-1040X

Name

Your Social Security Number

-

-

Spouse’s Name (if joint return)

Spouse’s Social Security Number

-

-

1. Enter the total number of W-2, W-2G, and 1099 forms showing Connecticut income

tax withholding reported below.

2. W-2, W-2G, and 1099 Identification Information

(only enter information from your W-2, W-2G, and 1099

forms if Connecticut income tax was withheld).

Column A

Column B

Column C

Employer Identification Number from your

Connecticut Wages, Tips, etc.

Connecticut Income Tax Withheld

W-2, W-2G, or 1099 Forms

,

,

.

.00

00

,

,

.

.00

00

,

,

.

.00

00

,

,

.

.00

00

,

,

.

.00

00

,

,

.

.00

00

,

,

.

.00

00

3. Total Connecticut Income Tax Withheld (reported above).

(Add the

,

,

.

amounts in Column C. Enter here and on Form CT-1040EZ, Line 10h, Form

00

CT-1040, Line 18h, Form CT-1040NR/PY, Line 20h, or Form CT-1040X, Line 21.)

Instructions for Completing Schedule CT-1040WH

Line 1 — Number of W-2s, W-2Gs, and 1099s. Enter the total number of

Enter the number from Box b in

W-2s, W-2Gs, and 1099s for the 2004 taxable year showing Connecticut

Column A above.

income tax withheld that you are reporting on this schedule (if you are filing a

joint return, include your spouse’s W-2s, W-2Gs, and 1099s). Verify that

Box 15 of each W-2 is Connecticut income tax withheld. Do not include

XX-XXXXXXX

W-2s, W-2Gs, or 1099s for other states or the IRS. See sample W-2 at right.

Line 2 — Column A - W-2, W-2G, and 1099 Identification Information.

Enter in Column A, the nine-digit Employer Identification Number of each

federal Form W-2 (located in Box b of federal Form W-2). For each 1099,

enter the payer’s nine-digit Federal Identification Number. For unemployment

compensation, this number is located directly below the address for the

Enter the amount

Department of Labor. If the number is unclear or missing, contact your employer

from Box 16 in

or payer.

Column B above.

Column B - Connecticut Wages, Tips, etc. - Enter in Column B the amount

of Connecticut wages, tips, etc. (located in Box 16 of federal Form W-2).

CT

XXX.00

XXX.00

Column C - Connecticut Income Tax Withheld. Enter in Column C, the

amount of Connecticut income tax withholding as shown on each federal

Form W-2,W-2G, or 1099 (from Form W-2, Box 17; Form W-2G, Box 14;

Form 1099-R, Box 10; Form 1099-MISC, Box 16; or Form UC-1099G, Box 5.)

Box 15 - Must show

Enter the amount from Box 17

Line 3 — Total Connecticut Income Tax Withheld (reported above).

(in whole dollars) in

CT to be claimed as

Column C above.

Connecticut Withholding.

Add the amounts in Line 2, Column C, and enter the total here.

Attach Schedule CT-1040WH to the back of Form CT-1040EZ, Form CT-1040, Form CT-1040NR/PY, or Form CT-1040X. If you

have additional federal Forms W-2, W-2G, and 1099, you must create an identical schedule and attach it to the back of your

Connecticut income tax return.

Schedule CT-1040WH (Rev. 12/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1