Form D-76a - Amended Dc Estate Tax Return

ADVERTISEMENT

Government of the

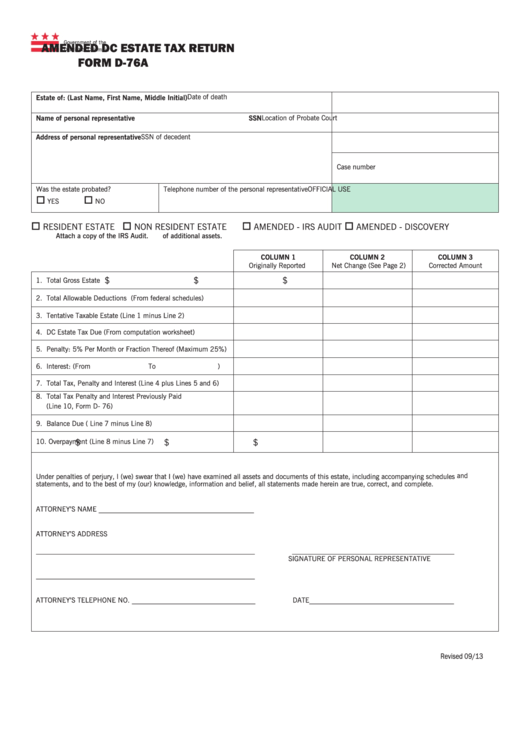

AMENDED DC ESTATE TAX RETURN

District of Columbia

FORM D-76A

Date of death

Estate of: (Last Name, First Name, Middle Initial)

Location of Probate Court

Name of personal representative

SSN

SSN of decedent

Address of personal representative

Case number

Was the estate probated?

Telephone number of the personal representative

OFFICIAL USE

YES

NO

RESIDENT ESTATE

NON RESIDENT ESTATE

AMENDED - IRS AUDIT

AMENDED - DISCOVERY

Attach a copy of the IRS Audit.

of additional assets.

COLUMN 1

COLUMN 2

COLUMN 3

Originally Reported

Net Change (See Page 2)

Corrected Amount

$

$

$

1. Total Gross Estate

2. Total Allowable Deductions (From federal schedules)

3. Tentative Taxable Estate (Line 1 minus Line 2)

4. DC Estate Tax Due (From computation worksheet)

5. Penalty: 5% Per Month or Fraction Thereof (Maximum 25%)

6. Interest: (From

To

)

7. Total Tax, Penalty and Interest (Line 4 plus Lines 5 and 6)

8. Total Tax Penalty and Interest Previously Paid

(Line 10, Form D- 76)

9. Balance Due ( Line 7 minus Line 8)

10. Overpayment (Line 8 minus Line 7)

$

$

$

Under penalties of perjury, I (we) swear that I (we) have examined all assets and documents of this estate, including accompanying schedules and

statements, and to the best of my (our) knowledge, information and belief, all statements made herein are true, correct, and complete.

ATTORNEY’S NAME ____________________________________________

ATTORNEY’S ADDRESS

______________________________________________________________

______________________________________________

SIGNATURE OF PERSONAL REPRESENTATIVE

______________________________________________________________

ATTORNEY’S TELEPHONE NO. ___________________________________

DATE_________________________________________

Revised 09/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2