Form Ct-8857 - Request For Innocent Spouse Relief (And Separation Of Liability And Equitable Relief)

ADVERTISEMENT

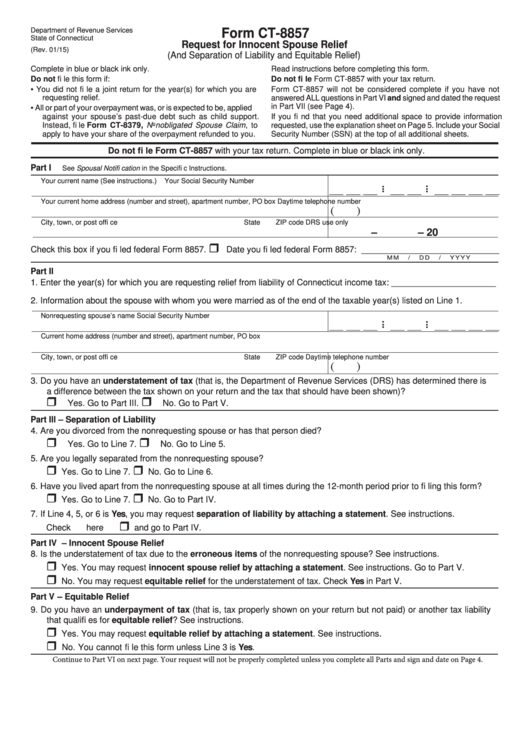

Department of Revenue Services

Form CT-8857

State of Connecticut

Request for Innocent Spouse Relief

(Rev. 01/15)

(And Separation of Liability and Equitable Relief)

Complete in blue or black ink only.

Read instructions before completing this form.

Do not fi le this form if:

Do not fi le Form CT-8857 with your tax return.

•

You did not fi le a joint return for the year(s) for which you are

Form CT-8857 will not be considered complete if you have not

requesting relief.

answered ALL questions in Part VI and signed and dated the request

in Part VII (see Page 4).

•

All or part of your overpayment was, or is expected to be, applied

against your spouse’s past-due debt such as child support.

If you fi nd that you need additional space to provide information

Instead, fi le Form CT-8379, Nonobligated Spouse Claim, to

requested, use the explanation sheet on Page 5. Include your Social

apply to have your share of the overpayment refunded to you.

Security Number (SSN) at the top of all additional sheets.

Do not fi le Form CT-8857 with your tax return. Complete in blue or black ink only.

Part I

See Spousal Notifi cation in the Specifi c Instructions.

Your current name (See instructions.)

Your Social Security Number

• •

• •

__ __ __

__ __

__ __ __ __

•

•

Your current home address (number and street), apartment number, PO box

Daytime telephone number

(

)

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

Check this box if you fi led federal Form 8857.

Date you fi led federal Form 8857: _____________________________

M M

/

D D

/

Y Y Y Y

Part II

1. Enter the year(s) for which you are requesting relief from liability of Connecticut income tax: ______________________

2. Information about the spouse with whom you were married as of the end of the taxable year(s) listed on Line 1.

Nonrequesting spouse’s name

Social Security Number

• •

• •

__ __ __

__ __

__ __ __ __

•

•

Current home address (number and street), apartment number, PO box

City, town, or post offi ce

State

ZIP code

Daytime telephone number

(

)

3. Do you have an understatement of tax (that is, the Department of Revenue Services (DRS) has determined there is

a difference between the tax shown on your return and the tax that should have been shown)?

Yes. Go to Part III.

No. Go to Part V.

Part III – Separation of Liability

4. Are you divorced from the nonrequesting spouse or has that person died?

Yes. Go to Line 7.

No. Go to Line 5.

5. Are you legally separated from the nonrequesting spouse?

Yes. Go to Line 7.

No. Go to Line 6.

6. Have you lived apart from the nonrequesting spouse at all times during the 12-month period prior to fi ling this form?

Yes. Go to Line 7.

No. Go to Part IV.

7. If Line 4, 5, or 6 is Yes, you may request separation of liability by attaching a statement. See instructions.

Check here

and go to Part IV.

Part IV – Innocent Spouse Relief

8. Is the understatement of tax due to the erroneous items of the nonrequesting spouse? See instructions.

Yes. You may request innocent spouse relief by attaching a statement. See instructions. Go to Part V.

No. You may request equitable relief for the understatement of tax. Check Yes in Part V.

Part V – Equitable Relief

9. Do you have an underpayment of tax (that is, tax properly shown on your return but not paid) or another tax liability

that qualifi es for equitable relief? See instructions.

Yes. You may request equitable relief by attaching a statement. See instructions.

No. You cannot fi le this form unless Line 3 is Yes.

Continue to Part VI on next page. Your request will not be properly completed unless you complete all Parts and sign and date on Page 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5