Form 200 Instructions - Request For Innocent Spouse Relief And Arizona Form Separation Of Liability And Equitable Relief - Arizona

ADVERTISEMENT

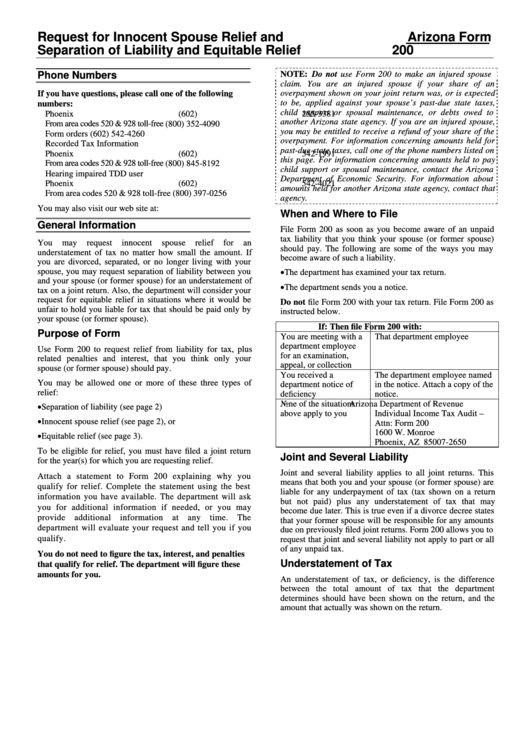

Request for Innocent Spouse Relief and

Arizona Form

Separation of Liability and Equitable Relief

200

NOTE: Do not use Form 200 to make an injured spouse

Phone Numbers

claim. You are an injured spouse if your share of an

overpayment shown on your joint return was, or is expected

If you have questions, please call one of the following

to be, applied against your spouse’s past-due state taxes,

numbers:

child support or spousal maintenance, or debts owed to

Phoenix

(602) 255-3381

another Arizona state agency. If you are an injured spouse,

From area codes 520 & 928 toll-free

(800) 352-4090

you may be entitled to receive a refund of your share of the

Form orders

(602) 542-4260

overpayment. For information concerning amounts held for

Recorded Tax Information

past-due state taxes, call one of the phone numbers listed on

Phoenix

(602) 542-1991

this page. For information concerning amounts held to pay

From area codes 520 & 928 toll-free

(800) 845-8192

child support or spousal maintenance, contact the Arizona

Hearing impaired TDD user

Department of Economic Security. For information about

Phoenix

(602) 542-4021

amounts held for another Arizona state agency, contact that

From area codes 520 & 928 toll-free

(800) 397-0256

agency.

You may also visit our web site at:

When and Where to File

General Information

File Form 200 as soon as you become aware of an unpaid

tax liability that you think your spouse (or former spouse)

You

may

request

innocent

spouse

relief

for

an

should pay. The following are some of the ways you may

understatement of tax no matter how small the amount. If

become aware of such a liability.

you are divorced, separated, or no longer living with your

•

spouse, you may request separation of liability between you

The department has examined your tax return.

and your spouse (or former spouse) for an understatement of

•

The department sends you a notice.

tax on a joint return. Also, the department will consider your

request for equitable relief in situations where it would be

Do not file Form 200 with your tax return. File Form 200 as

unfair to hold you liable for tax that should be paid only by

instructed below.

your spouse (or former spouse).

If:

Then file Form 200 with:

Purpose of Form

You are meeting with a

That department employee

department employee

Use Form 200 to request relief from liability for tax, plus

for an examination,

related penalties and interest, that you think only your

appeal, or collection

spouse (or former spouse) should pay.

You received a

The department employee named

You may be allowed one or more of these three types of

department notice of

in the notice. Attach a copy of the

relief:

deficiency

notice.

None of the situations

Arizona Department of Revenue

•

Separation of liability (see page 2)

above apply to you

Individual Income Tax Audit –

•

Innocent spouse relief (see page 2), or

Attn: Form 200

1600 W. Monroe

•

Equitable relief (see page 3).

Phoenix, AZ 85007-2650

To be eligible for relief, you must have filed a joint return

Joint and Several Liability

for the year(s) for which you are requesting relief.

Joint and several liability applies to all joint returns. This

Attach a statement to Form 200 explaining why you

means that both you and your spouse (or former spouse) are

qualify for relief. Complete the statement using the best

liable for any underpayment of tax (tax shown on a return

information you have available. The department will ask

but not paid) plus any understatement of tax that may

you for additional information if needed, or you may

become due later. This is true even if a divorce decree states

provide additional information at any time. The

that your former spouse will be responsible for any amounts

department will evaluate your request and tell you if you

due on previously filed joint returns. Form 200 allows you to

qualify.

request that joint and several liability not apply to part or all

of any unpaid tax.

You do not need to figure the tax, interest, and penalties

Understatement of Tax

that qualify for relief. The department will figure these

amounts for you.

An understatement of tax, or deficiency, is the difference

between the total amount of tax that the department

determines should have been shown on the return, and the

amount that actually was shown on the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3