Form 8857 - Request For Innocent Spouse Relief, Separation Of Liability, And Equitable Relief

ADVERTISEMENT

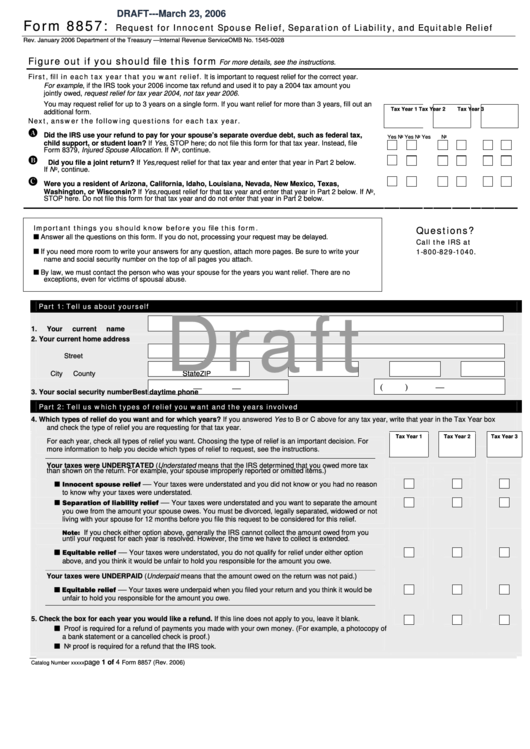

DRAFT---March 23, 2006

Form 8857:

Request for Innocent Spouse Relief, Separation of Liability, and Equitable Relief

Rev. January 2006

Department of the Treasury — Internal Revenue Service

OMB No. 1545-0028

Figure out if you should file this form

For more details, see the instructions.

First, fill in each tax year that you want relief. It is important to request relief for the correct year.

For example, if the IRS took your 2006 income tax refund and used it to pay a 2004 tax amount you

jointly owed, request relief for tax year 2004, not tax year 2006.

You may request relief for up to 3 years on a single form. If you want relief for more than 3 years, fill out an

Tax Year 1

Tax Year 2

Tax Year 3

additional form.

Next, answer the following questions for each tax year.

Did the IRS use your refund to pay for your spouse’s separate overdue debt, such as federal tax,

Yes

No

Yes

No

Yes

No

child support, or student loan? If Yes, STOP here; do not file this form for that tax year. Instead, file

Form 8379, Injured Spouse Allocation. If No, continue.

Did you file a joint return? If Yes, request relief for that tax year and enter that year in Part 2 below.

If No, continue.

Were you a resident of Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas,

Washington, or Wisconsin? If Yes, request relief for that tax year and enter that year in Part 2 below. If No,

STOP here. Do not file this form for that tax year and do not enter that year in Part 2 below.

Important things you should know before you file this form.

Questions?

Answer all the questions on this form. If you do not, processing your request may be delayed.

Call the IRS at

1-800-829-1040.

If you need more room to write your answers for any question, attach more pages. Be sure to write your

name and social security number on the top of all pages you attach.

By law, we must contact the person who was your spouse for the years you want relief. There are no

exceptions, even for victims of spousal abuse.

Draft

Part 1: Tell us about yourself

1.

Your current name

2.

Your current home address

Street

State

City

County

ZIP

(

)

—

—

—

3.

Your social security number

Best daytime phone

Part 2: Tell us which types of relief you want and the years involved

4.

Which types of relief do you want and for which years? If you answered Yes to B or C above for any tax year, write that year in the Tax Year box

and check the type of relief you are requesting for that tax year.

Tax Year 1

Tax Year 2

Tax Year 3

For each year, check all types of relief you want. Choosing the type of relief is an important decision. For

more information to help you decide which types of relief to request, see the instructions.

Your taxes were UNDERSTATED (Understated means that the IRS determined that you owed more tax

than shown on the return. For example, your spouse improperly reported or omitted items.)

Innocent spouse relief

—

Your taxes were understated and you did not know or you had no reason

to know why your taxes were understated.

Separation of liability relief

—

Your taxes were understated and you want to separate the amount

you owe from the amount your spouse owes. You must be divorced, legally separated, widowed or not

living with your spouse for 12 months before you file this request to be considered for this relief.

Note:

If you check either option above, generally the IRS cannot collect the amount owed from you

until your request for each year is resolved. However, the time we have to collect is extended.

Equitable relief

—

Your taxes were understated, you do not qualify for relief under either option

above, and you think it would be unfair to hold you responsible for the amount you owe.

Your taxes were UNDERPAID (Underpaid means that the amount owed on the return was not paid.)

Equitable relief

—

Your taxes were underpaid when you filed your return and you think it would be

unfair to hold you responsible for the amount you owe.

5.

Check the box for each year you would like a refund. If this line does not apply to you, leave it blank.

Proof is required for a refund of payments you made with your own money. (For example, a photocopy of

a bank statement or a cancelled check is proof.)

No proof is required for a refund that the IRS took.

page 1 of 4

Form 8857 (Rev. 2006)

Catalog Number xxxxx

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4