Alcoholic Beverage Excise Tax Return Form - City Of Jasper - 2014

ADVERTISEMENT

CITY OF JASPER

-

200 Burnt Mountain Road - Jasper, GA 30143

Phone: 706-692-9100

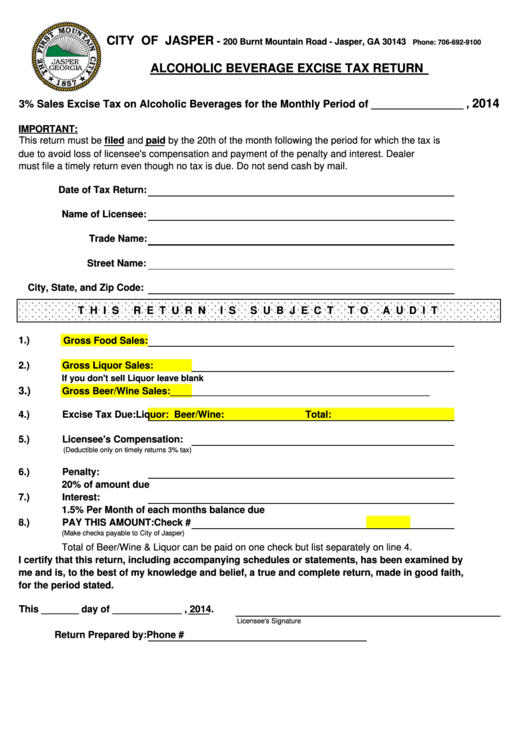

ALCOHOLIC BEVERAGE EXCISE TAX RETURN

2014

3% Sales Excise Tax on Alcoholic Beverages for the Monthly Period of ________________ ,

IMPORTANT:

This return must be filed and paid by the 20th of the month following the period for which the tax is

due to avoid loss of licensee's compensation and payment of the penalty and interest. Dealer

must file a timely return even though no tax is due. Do not send cash by mail.

Date of Tax Return:

Name of Licensee:

Trade Name:

Street Name:

City, State, and Zip Code:

T H I S

R E T U R N

I S

S U B J E C T

T O

A U D I T

1.)

Gross Food Sales:

2.)

Gross Liquor Sales:

If you don't sell Liquor leave blank

3.)

_____________________________________________

Gross Beer/Wine Sales:

4.)

Excise Tax Due:

Liquor:

Beer/Wine:

Total:

5.)

Licensee's Compensation:

(Deductible only on timely returns 3% tax)

6.)

Penalty:

20% of amount due

7.)

Interest:

1.5% Per Month of each months balance due

8.)

PAY THIS AMOUNT:

Check #

(Make checks payable to City of Jasper)

Total of Beer/Wine & Liquor can be paid on one check but list separately on line 4.

I certify that this return, including accompanying schedules or statements, has been examined by

me and is, to the best of my knowledge and belief, a true and complete return, made in good faith,

for the period stated.

This _______ day of _____________ , 2014.

Licensee's Signature

Return Prepared by:

Phone #

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1