Form Ct-1120x - Amended Corporation Business Tax Return - 2014

ADVERTISEMENT

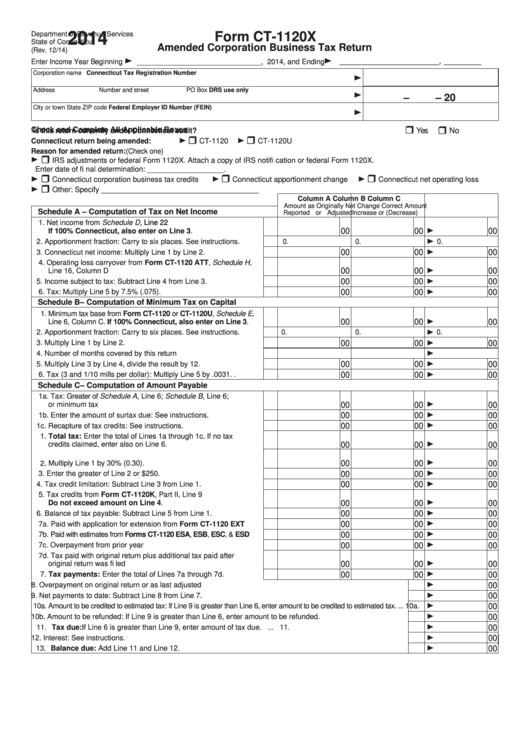

Department of Revenue Services

2014

Form CT-1120X

State of Connecticut

Amended Corporation Business Tax Return

(Rev. 12/14)

Enter Income Year Beginning

______________________________, 2014, and Ending

________________________ , _________

Corporation name

Connecticut Tax Registration Number

Address

Number and street

PO Box

DRS use only

–

– 20

City or town

State

ZIP code

Federal Employer ID Number (FEIN)

Check and Complete All Applicable Boxes

Yes

No

Is this return currently under Connecticut audit?

Connecticut return being amended:

CT-1120

CT-1120U

Reason for amended return: (Check one)

IRS adjustments or federal Form 1120X. Attach a copy of IRS notifi cation or federal Form 1120X.

Enter date of fi nal determination: __________________.

Connecticut corporation business tax credits

Connecticut apportionment change

Connecticut net operating loss

Other: Specify _____________________________________

Column A

Column B

Column C

Amount as Originally

Net Change

Correct Amount

Schedule A – Computation of Tax on Net Income

Reported or Adjusted

Increase or (Decrease)

1. Net income from Schedule D,

Line 22

00

00

00

If 100% Connecticut, also enter on Line 3. ................................

1.

2. Apportionment fraction: Carry to six places. See instructions. .......

2.

0.

0.

0.

00

00

00

3. Connecticut net income: Multiply Line 1 by Line 2. .......................

3.

4. Operating loss carryover from Form CT-1120 ATT, Schedule H,

00

00

00

Line 16, Column D ..........................................................................

4.

5. Income subject to tax: Subtract Line 4 from Line 3. ......................

5.

00

00

00

6. Tax: Multiply Line 5 by 7.5% (.075). ...............................................

6.

00

00

00

Schedule B – Computation of Minimum Tax on Capital

1. Minimum tax base from Form CT-1120 or CT-1120U, Schedule E,

00

00

00

Line 6, Column C. If 100% Connecticut, also enter on Line 3. ....

1.

2. Apportionment fraction: Carry to six places. See instructions. .....

2.

0.

0.

0.

3. Multiply Line 1 by Line 2. ...............................................................

3.

00

00

00

4. Number of months covered by this return ......................................

4.

5. Multiply Line 3 by Line 4, divide the result by 12. ..........................

5.

00

00

00

6. Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031. . ...........

6.

00

00

00

Schedule C – Computation of Amount Payable

1a. Tax: Greater of Schedule A, Line 6; Schedule B, Line 6;

or minimum tax ............................................................................... 1a.

00

00

00

1b. Enter the amount of surtax due: See instructions. ......................... 1b.

00

00

00

1c. Recapture of tax credits: See instructions. .................................... 1c.

00

00

00

1. Total tax: Enter the total of Lines 1a through 1c. If no tax

credits claimed, enter also on Line 6. ............................................

1.

00

00

00

00

00

00

2. Multiply Line 1 by 30% (0.30). ........................................................

2.

3. Enter the greater of Line 2 or $250. ...............................................

3.

00

00

00

4. Tax credit limitation: Subtract Line 3 from Line 1. ..........................

4.

00

00

00

5. Tax credits from Form CT-1120K, Part II, Line 9

Do not exceed amount on Line 4. ..............................................

5.

00

00

00

6. Balance of tax payable: Subtract Line 5 from Line 1. ....................

6.

00

00

00

7a. Paid with application for extension from Form CT-1120 EXT ...... 7a.

00

00

00

7b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, & ESD ...... 7b.

00

00

00

7c. Overpayment from prior year ......................................................... 7c.

00

00

00

7d. Tax paid with original return plus additional tax paid after

00

00

00

original return was fi led .................................................................. 7d.

7. Tax payments: Enter the total of Lines 7a through 7d. ................

7.

00

00

00

8. Overpayment on original return or as last adjusted ..............................................................................................

8.

00

9. Net payments to date: Subtract Line 8 from Line 7. ..............................................................................................

9.

00

10a. Amount to be credited to estimated tax: If Line 9 is greater than Line 6, enter amount to be credited to estimated tax. ... 10a.

00

10b. Amount to be refunded: If Line 9 is greater than Line 6, enter amount to be refunded. ....................................... 10b.

00

11. Tax due: If Line 6 is greater than Line 9, enter amount of tax due. ..................................................................... 11.

00

12. Interest: See instructions. ..................................................................................................................................... 12.

00

13. Balance due: Add Line 11 and Line 12. ............................................................................................................... 13.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2