Form Rev-489 - Instructions For Pa-40 Schedule Ue - Individual Income Tax Return - 2016

ADVERTISEMENT

REV-489 (12-15)

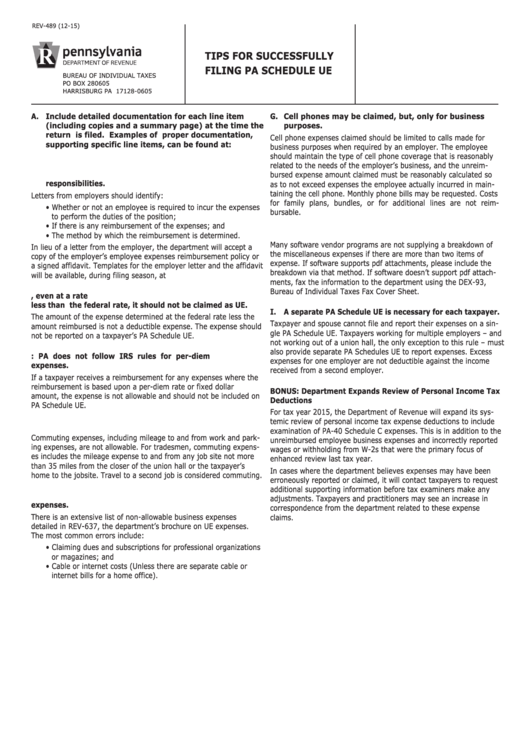

TIPS FOR SUCCESSFULLY

FILING PA SCHEDULE UE

BUREAU OF INDIVIDUAL TAXES

PO BOX 280605

HARRISBURG PA 17128-0605

A. Include detailed documentation for each line item

G. Cell phones may be claimed, but, only for business

(including copies and a summary page) at the time the

purposes.

return is filed. Examples of proper documentation,

Cell phone expenses claimed should be limited to calls made for

supporting specific line items, can be found at:

business purposes when required by an employer. The employee

should maintain the type of cell phone coverage that is reasonably

related to the needs of the employer’s business, and the unreim-

B. Documentation should clarify unreimbursed expense

bursed expense amount claimed must be reasonably calculated so

responsibilities.

as to not exceed expenses the employee actually incurred in main-

taining the cell phone. Monthly phone bills may be requested. Costs

Letters from employers should identify:

for family plans, bundles, or for additional lines are not reim-

• Whether or not an employee is required to incur the expenses

bursable.

to perform the duties of the position;

• If there is any reimbursement of the expenses; and

H. Include breakdowns of all miscellaneous expenses.

• The method by which the reimbursement is determined.

Many software vendor programs are not supplying a breakdown of

In lieu of a letter from the employer, the department will accept a

the miscellaneous expenses if there are more than two items of

copy of the employer’s employee expenses reimbursement policy or

expense. If software supports pdf attachments, please include the

a signed affidavit. Templates for the employer letter and the affidavit

breakdown via that method. If software doesn’t support pdf attach-

will be available, during filing season, at

ments, fax the information to the department using the DEX-93,

Bureau of Individual Taxes Fax Cover Sheet.

C. If mileage is reimbursed by an employer, even at a rate

less than the federal rate, it should not be claimed as UE.

I. A separate PA Schedule UE is necessary for each taxpayer.

The amount of the expense determined at the federal rate less the

Taxpayer and spouse cannot file and report their expenses on a sin-

amount reimbursed is not a deductible expense. The expense should

gle PA Schedule UE. Taxpayers working for multiple employers – and

not be reported on a taxpayer’s PA Schedule UE.

not working out of a union hall, the only exception to this rule – must

also provide separate PA Schedules UE to report expenses. Excess

D. Reminder: PA does not follow IRS rules for per-diem

expenses for one employer are not deductible against the income

expenses.

received from a second employer.

If a taxpayer receives a reimbursement for any expenses where the

reimbursement is based upon a per-diem rate or fixed dollar

BONUS: Department Expands Review of Personal Income Tax

amount, the expense is not allowable and should not be included on

Deductions

PA Schedule UE.

For tax year 2015, the Department of Revenue will expand its sys-

temic review of personal income tax expense deductions to include

E. Commuting expenses are not deductible in PA.

examination of PA-40 Schedule C expenses. This is in addition to the

Commuting expenses, including mileage to and from work and park-

unreimbursed employee business expenses and incorrectly reported

ing expenses, are not allowable. For tradesmen, commuting expens-

wages or withholding from W-2s that were the primary focus of

es includes the mileage expense to and from any job site not more

enhanced review last tax year.

than 35 miles from the closer of the union hall or the taxpayer’s

In cases where the department believes expenses may have been

home to the jobsite. Travel to a second job is considered commuting.

erroneously reported or claimed, it will contact taxpayers to request

additional supporting information before tax examiners make any

F. Review REV-637 for a listing of common unallowable

adjustments. Taxpayers and practitioners may see an increase in

expenses.

correspondence from the department related to these expense

There is an extensive list of non-allowable business expenses

claims.

detailed in REV-637, the department’s brochure on UE expenses.

The most common errors include:

• Claiming dues and subscriptions for professional organizations

or magazines; and

• Cable or internet costs (Unless there are separate cable or

internet bills for a home office).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7