School District Estimated Payment Worksheet - 2002

ADVERTISEMENT

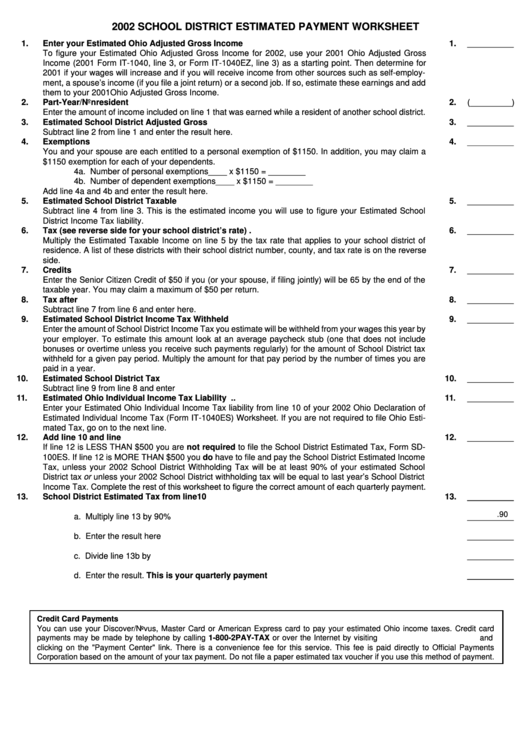

2002 SCHOOL DISTRICT ESTIMATED PAYMENT WORKSHEET

1.

Enter your Estimated Ohio Adjusted Gross Income ............................................................................

1.

__________

To figure your Estimated Ohio Adjusted Gross Income for 2002, use your 2001 Ohio Adjusted Gross

Income (2001 Form IT-1040, line 3, or Form IT-1040EZ, line 3) as a starting point. Then determine for

2001 if your wages will increase and if you will receive income from other sources such as self-employ-

ment, a spouse’s income (if you file a joint return) or a second job. If so, estimate these earnings and add

them to your 2001Ohio Adjusted Gross Income.

2.

Part-Year/Nonresident Deduction ..........................................................................................................

2.

(_________)

Enter the amount of income included on line 1 that was earned while a resident of another school district.

3.

Estimated School District Adjusted Gross Income ..............................................................................

3.

__________

Subtract line 2 from line 1 and enter the result here.

4.

Exemptions ..............................................................................................................................................

4.

__________

You and your spouse are each entitled to a personal exemption of $1150. In addition, you may claim a

$1150 exemption for each of your dependents.

4a. Number of personal exemptions

____ x $1150 = ________

4b. Number of dependent exemptions

____ x $1150 = ________

Add line 4a and 4b and enter the result here.

5.

Estimated School District Taxable Income ...........................................................................................

5.

__________

Subtract line 4 from line 3. This is the estimated income you will use to figure your Estimated School

District Income Tax liability.

6.

Tax (see reverse side for your school district’s rate) ..........................................................................

6.

__________

Multiply the Estimated Taxable Income on line 5 by the tax rate that applies to your school district of

residence. A list of these districts with their school district number, county, and tax rate is on the reverse

side.

7.

Credits ......................................................................................................................................................

7.

__________

Enter the Senior Citizen Credit of $50 if you (or your spouse, if filing jointly) will be 65 by the end of the

taxable year. You may claim a maximum of $50 per return.

8.

Tax after Credits ......................................................................................................................................

8.

__________

Subtract line 7 from line 6 and enter here.

9.

Estimated School District Income Tax Withheld ..................................................................................

9.

__________

Enter the amount of School District Income Tax you estimate will be withheld from your wages this year by

your employer. To estimate this amount look at an average paycheck stub (one that does not include

bonuses or overtime unless you receive such payments regularly) for the amount of School District tax

withheld for a given pay period. Multiply the amount for that pay period by the number of times you are

paid in a year.

10.

Estimated School District Tax Due ........................................................................................................

10.

__________

Subtract line 9 from line 8 and enter here.This is your Estimated School District Income Tax liability.

11.

Estimated Ohio Individual Income Tax Liability ...................................................................................

11.

__________

Enter your Estimated Ohio Individual Income Tax liability from line 10 of your 2002 Ohio Declaration of

Estimated Individual Income Tax (Form IT-1040ES) Worksheet. If you are not required to file Ohio Esti-

mated Tax, go on to the next line.

12.

Add line 10 and line 11 ............................................................................................................................

12.

__________

If line 12 is LESS THAN $500 you are not required to file the School District Estimated Tax, Form SD-

100ES. If line 12 is MORE THAN $500 you do have to file and pay the School District Estimated Income

Tax, unless your 2002 School District Withholding Tax will be at least 90% of your estimated School

District tax or unless your 2002 School District withholding tax will be equal to last year’s School District

Income Tax. Complete the rest of this worksheet to figure the correct amount of each quarterly payment.

13.

School District Estimated Tax from line 10 ...........................................................................................

13.

__________

.90

a. Multiply line 13 by 90% ...........................................................................................................

__________

b. Enter the result here ...............................................................................................................

__________

c. Divide line 13b by 4 ................................................................................................................

__________

d. Enter the result. This is your quarterly payment .................................................................

__________

Credit Card Payments

You can use your Discover/Novus, Master Card or American Express card to pay your estimated Ohio income taxes. Credit card

payments may be made by telephone by calling 1-800-2PAY-TAX or over the Internet by visiting and

clicking on the "Payment Center" link. There is a convenience fee for this service. This fee is paid directly to Official Payments

Corporation based on the amount of your tax payment. Do not file a paper estimated tax voucher if you use this method of payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2