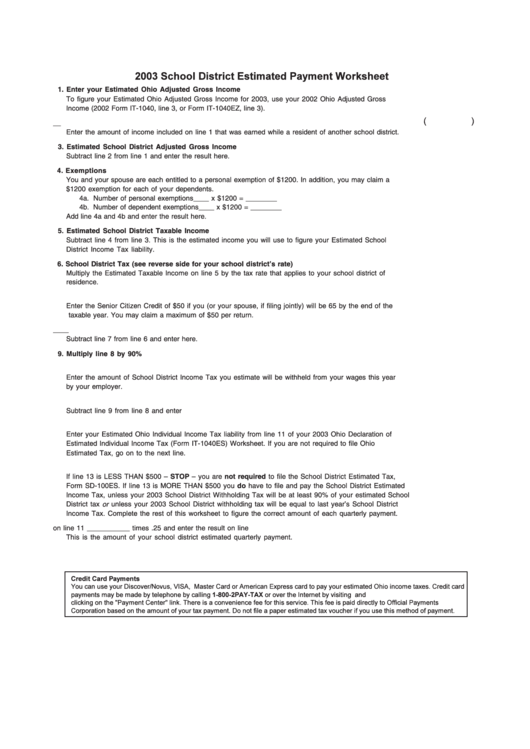

2003 School District Estimated Payment Worksheet

ADVERTISEMENT

1. Enter your Estimated Ohio Adjusted Gross Income ..................................................................................

1. ___________

To figure your Estimated Ohio Adjusted Gross Income for 2003, use your 2002 Ohio Adjusted Gross

Income (2002 Form IT-1040, line 3, or Form IT-1040EZ, line 3).

2. Part-Year/Nonresident Deduction ..................................................................................................................

2. ___________

Enter the amount of income included on line 1 that was earned while a resident of another school district.

3. Estimated School District Adjusted Gross Income ....................................................................................

3. ___________

Subtract line 2 from line 1 and enter the result here.

4. Exemptions ......................................................................................................................................................

4. ___________

You and your spouse are each entitled to a personal exemption of $1200. In addition, you may claim a

$1200 exemption for each of your dependents.

4a. Number of personal exemptions

____ x $1200 = ________

4b. Number of dependent exemptions

____ x $1200 = ________

Add line 4a and 4b and enter the result here.

5. Estimated School District Taxable Income ..................................................................................................

5. ___________

Subtract line 4 from line 3. This is the estimated income you will use to figure your Estimated School

District Income Tax liability.

6. School District Tax (see reverse side for your school district’s rate) .......................................................

6. ___________

Multiply the Estimated Taxable Income on line 5 by the tax rate that applies to your school district of

residence.

7. Credits ...............................................................................................................................................................

7. ___________

Enter the Senior Citizen Credit of $50 if you (or your spouse, if filing jointly) will be 65 by the end of the

taxable year. You may claim a maximum of $50 per return.

8. School District Tax after Credits ....................................................................................................................

8. ___________

Subtract line 7 from line 6 and enter here.

9. Multiply line 8 by 90% .....................................................................................................................................

9. ___________

10. Estimated School District Income Tax Withheld .........................................................................................

10. ___________

Enter the amount of School District Income Tax you estimate will be withheld from your wages this year

by your employer.

11. Estimated School District Tax Due ................................................................................................................

11. ___________

Subtract line 9 from line 8 and enter here.This is your Estimated School District Income Tax liability.

12. Estimated Ohio Individual Income Tax Liability .........................................................................................

12. ___________

Enter your Estimated Ohio Individual Income Tax liability from line 11 of your 2003 Ohio Declaration of

Estimated Individual Income Tax (Form IT-1040ES) Worksheet. If you are not required to file Ohio

Estimated Tax, go on to the next line.

13. Add line 11 and line 12 ...................................................................................................................................

13. ___________

If line 13 is LESS THAN $500 – STOP – you are not required to file the School District Estimated Tax,

Form SD-100ES. If line 13 is MORE THAN $500 you do have to file and pay the School District Estimated

Income Tax, unless your 2003 School District Withholding Tax will be at least 90% of your estimated School

District tax or unless your 2003 School District withholding tax will be equal to last year’s School District

Income Tax. Complete the rest of this worksheet to figure the correct amount of each quarterly payment.

14. Multiply the amount on line 11 ___________ times .25 and enter the result on line 14. .............................

14. ___________

This is the amount of your school district estimated quarterly payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2