Withholding Tax Telefile Worksheet

ADVERTISEMENT

Search

l

k

j

i

n

m

l

k

j

n

m

l

k

j

n

m

l

k

j

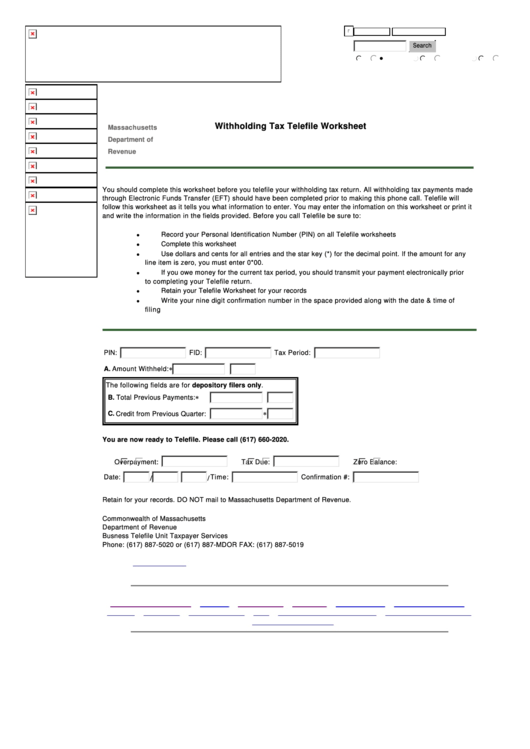

Withholding Tax Telefile Worksheet

Massachusetts

Department of

Revenue

You should complete this worksheet before you telefile your withholding tax return. All withholding tax payments made

through Electronic Funds Transfer (EFT) should have been completed prior to making this phone call. Telefile will

follow this worksheet as it tells you what information to enter. You may enter the infomation on this worksheet or print it

and write the information in the fields provided. Before you call Telefile be sure to:

Record your Personal Identification Number (PIN) on all Telefile worksheets

l

Complete this worksheet

l

Use dollars and cents for all entries and the star key (*) for the decimal point. If the amount for any

l

line item is zero, you must enter 0*00.

If you owe money for the current tax period, you should transmit your payment electronically prior

l

to completing your Telefile return.

Retain your Telefile Worksheet for your records

l

Write your nine digit confirmation number in the space provided along with the date & time of

l

filing

PIN:

FID:

Tax Period:

A. Amount Withheld:

*

The following fields are for depository filers only.

B. Total Previous Payments:

*

C. Credit from Previous Quarter:

*

You are now ready to Telefile. Please call (617) 660-2020.

g

f

e

d

c

g

f

e

d

c

g

f

e

d

c

Overpayment:

Tax Due:

Zero Balance:

Date:

Time:

Confirmation #:

/

/

Retain for your records. DO NOT mail to Massachusetts Department of Revenue.

Commonwealth of Massachusetts

Department of Revenue

Busness Telefile Unit Taxpayer Services

Phone: (617) 887-5020 or (617) 887-MDOR FAX: (617) 887-5019

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1