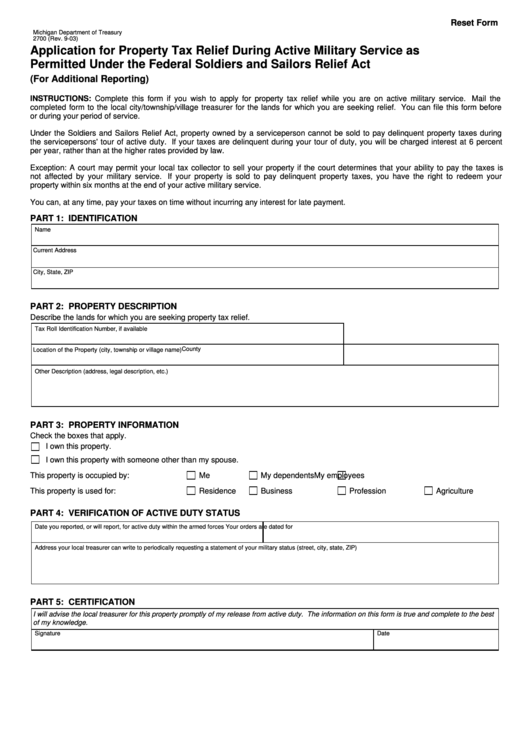

Reset Form

Michigan Department of Treasury

2700 (Rev. 9-03)

Application for Property Tax Relief During Active Military Service as

Permitted Under the Federal Soldiers and Sailors Relief Act

(For Additional Reporting)

INSTRUCTIONS: Complete this form if you wish to apply for property tax relief while you are on active military service. Mail the

completed form to the local city/township/village treasurer for the lands for which you are seeking relief. You can file this form before

or during your period of service.

Under the Soldiers and Sailors Relief Act, property owned by a serviceperson cannot be sold to pay delinquent property taxes during

the servicepersons' tour of active duty. If your taxes are delinquent during your tour of duty, you will be charged interest at 6 percent

per year, rather than at the higher rates provided by law.

Exception: A court may permit your local tax collector to sell your property if the court determines that your ability to pay the taxes is

not affected by your military service. If your property is sold to pay delinquent property taxes, you have the right to redeem your

property within six months at the end of your active military service.

You can, at any time, pay your taxes on time without incurring any interest for late payment.

PART 1: IDENTIFICATION

Name

Current Address

City, State, ZIP

PART 2: PROPERTY DESCRIPTION

Describe the lands for which you are seeking property tax relief.

Tax Roll Identification Number, if available

County

Location of the Property (city, township or village name)

Other Description (address, legal description, etc.)

PART 3: PROPERTY INFORMATION

Check the boxes that apply.

I own this property.

I own this property with someone other than my spouse.

This property is occupied by:

Me

My dependents

My employees

This property is used for:

Residence

Business

Profession

Agriculture

PART 4: VERIFICATION OF ACTIVE DUTY STATUS

Date you reported, or will report, for active duty within the armed forces

Your orders are dated for

Address your local treasurer can write to periodically requesting a statement of your military status (street, city, state, ZIP)

PART 5: CERTIFICATION

I will advise the local treasurer for this property promptly of my release from active duty. The information on this form is true and complete to the best

of my knowledge.

Signature

Date

1

1