Transient Room Tax Form - City Of Kodiak - Ordinance 676

ADVERTISEMENT

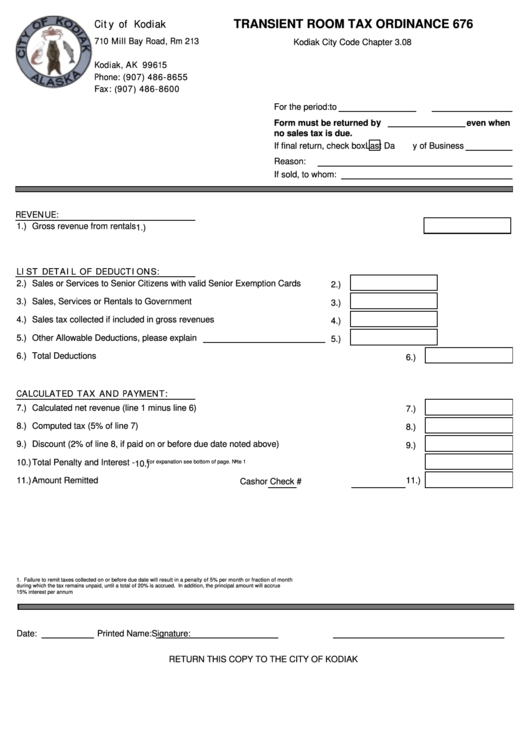

City of Kodiak

TRANSIENT ROOM TAX ORDINANCE 676

710 Mill Bay Road, Rm 213

Kodiak City Code Chapter 3.08

P.O. Box 1397

Kodiak, AK 99615

Phone: (907) 486-8655

Fax: (907) 486-8600

For the period:

to

Form must be returned by

even when

no sales tax is due.

If final return, check box

Last Day of Business

Reason:

If sold, to whom:

REVENUE:

1.)

Gross revenue from rentals

1.)

LIST DETAIL OF DEDUCTIONS:

2.)

Sales or Services to Senior Citizens with valid Senior Exemption Cards

2.)

3.)

Sales, Services or Rentals to Government

3.)

4.)

Sales tax collected if included in gross revenues

4.)

5.)

Other Allowable Deductions, please explain

5.)

6.)

Total Deductions

6.)

CALCULATED TAX AND PAYMENT:

7.)

Calculated net revenue (line 1 minus line 6)

7.)

8.)

Computed tax (5% of line 7)

8.)

9.)

Discount (2% of line 8, if paid on or before due date noted above)

9.)

10.)

Total Penalty and Interest -

For expanation see bottom of page. Note 1

10.)

11.)

Amount Remitted

11.)

Cash

or Check #

1. Failure to remit taxes collected on or before due date will result in a penalty of 5% per month or fraction of month

during which the tax remains unpaid, until a total of 20% is accrued. In addition, the principal amount will accrue

15% interest per annum

Date:

Printed Name:

Signature:

RETURN THIS COPY TO THE CITY OF KODIAK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2