Reset Form

Print Form

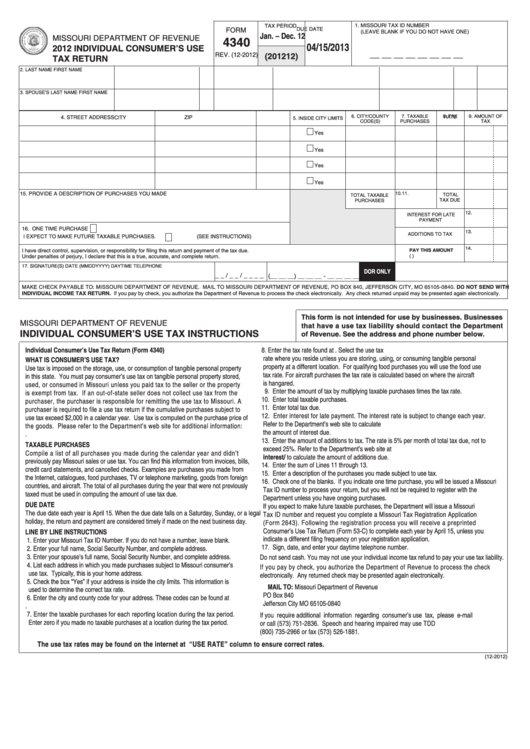

1. MISSOURI TAX ID NUMBER

TAX PERIOD

DUE DATE

FORM

(LEAVE BLANK IF YOU DO NOT HAVE ONE)

Jan. – Dec. 12

MISSOURI DEPARTMENT OF REVENUE

4340

04/15/2013

2012 INDIVIDUAL CONSUMER’S USE

__ __ __ __ __ __ __ __

REV. (12-2012)

(201212)

TAX RETURN

2. LAST NAME

FIRST NAME

M.I.

SSN

STREET ADDRESS

CITY

STATE

ZIP

3. SPOUSE’S LAST NAME

FIRST NAME

M.I.

SPOUSE SSN

STREET ADDRESS

CITY

STATE

ZIP

6. CITY/COUNTY

7. TAXABLE

8. TAX

9. AMOUNT OF

4. STREET ADDRESS

CITY

ZIP

5. INSIDE CITY LIMITS

CODE(S)

PURCHASES

RATE

TAX

Yes

Yes

Yes

Yes

15. PROVIDE A DESCRIPTION OF PURCHASES YOU MADE

10.

11.

TOTAL

TOTAL TAXABLE

TAX DUE

PURCHASES

12.

INTEREST FOR LATE

PAYMENT

16. ONE TIME PURCHASE

13.

ADDITIONS TO TAX

I EXPECT TO MAKE FUTURE TAXABLE PURCHASES.

(SEE INSTRUCTIONS)

14.

PAY THIS AMOUNT

I have direct control, supervision, or responsibility for filing this return and payment of the tax due.

Under penalties of perjury, I declare that this is a true, accurate, and complete return.

(U.S. funds only)

17. SIGNATURE(S)

DATE (MMDDYYYY)

DAYTIME TELEPHONE

DOR ONLY

_ _ / _ _ / _ _ _ _ (__ __ __) __ __ __ - __ __ __ __

MAKE CHECK PAYABLE TO: MISSOURI DEPARTMENT OF REVENUE. MAIL TO MISSOURI DEPARTMENT OF REVENUE, PO BOX 840, JEFFERSON CITY, MO 65105-0840. DO NOT SEND WITH

INDIVIDUAL INCOME TAX RETURN. If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

This form is not intended for use by businesses. Businesses

MISSOURI DEPARTMENT OF REVENUE

that have a use tax liability should contact the Department

INDIVIDUAL CONSUMER’S USE TAX INSTRUCTIONS

of Revenue. See the address and phone number below.

Individual Consumer’s Use Tax Return (Form 4340)

8. Enter the tax rate found at Select the use tax

rate where you reside unless you are storing, using, or consuming tangible personal

WHAT IS CONSUMER’S USE TAX?

property at a different location. For qualifying food purchases you will use the food use

Use tax is imposed on the storage, use, or consumption of tangible personal property

tax rate. For aircraft purchases the tax rate is calculated based on where the aircraft

in this state. You must pay consumer’s use tax on tangible personal property stored,

is hangared.

used, or consumed in Missouri unless you paid tax to the seller or the property

9. Enter the amount of tax by multiplying taxable purchases times the tax rate.

is exempt from tax. If an out-of-state seller does not collect use tax from the

10. Enter total taxable purchases.

purchaser, the purchaser is responsible for remitting the use tax to Missouri. A

11. Enter total tax due.

purchaser is required to file a use tax return if the cumulative purchases subject to

12. Enter interest for late payment. The interest rate is subject to change each year.

use tax exceed $2,000 in a calendar year. Use tax is computed on the purchase price of

Refer to the Department’s web site to calculate

the goods. Please refer to the Department’s web site for additional information:

the amount of interest due.

13. Enter the amount of additions to tax. The rate is 5% per month of total tax due, not to

TAXABLE PURCHASES

exceed 25%. Refer to the Department’s web site at

Compile a list of all purchases you made during the calendar year and didn’t

interest/ to calculate the amount of additions due.

previously pay Missouri sales or use tax. You can find this information from invoices, bills,

14. Enter the sum of Lines 11 through 13.

credit card statements, and cancelled checks. Examples are purchases you made from

15. Enter a description of the purchases you made subject to use tax.

the Internet, catalogues, food purchases, TV or telephone marketing, goods from foreign

16. Check one of the blanks. If you indicate one time purchase, you will be issued a Missouri

countries, and aircraft. The total of all purchases during the year that were not previously

Tax ID number to process your return, but you will not be required to register with the

taxed must be used in computing the amount of use tax due.

Department unless you have ongoing purchases.

DUE DATE

If you expect to make future taxable purchases, the Department will issue a Missouri

The due date each year is April 15. When the due date falls on a Saturday, Sunday, or a legal

Tax ID number and request you complete a Missouri Tax Registration Application

holiday, the return and payment are considered timely if made on the next business day.

(Form 2643). Following the registration process you will receive a preprinted

Consumer’s Use Tax Return (Form 53-C) to complete each year by April 15, unless you

LINE BY LINE INSTRUCTIONS

indicate a different filing frequency on your registration application.

1. Enter your Missouri Tax ID Number. If you do not have a number, leave blank.

17. Sign, date, and enter your daytime telephone number.

2. Enter your full name, Social Security Number, and complete address.

3. Enter your spouse’s full name, Social Security Number, and complete address.

Do not send cash. You may not use your individual income tax refund to pay your use tax liability.

4. List each address in which you made purchases subject to Missouri consumer’s

If you pay by check, you authorize the Department of Revenue to process the check

use tax. Typically, this is your home address.

electronically. Any returned check may be presented again electronically.

5. Check the box “Yes” if your address is inside the city limits. This information is

MAIL TO:

Missouri Department of Revenue

used to determine the correct tax rate.

PO Box 840

6. Enter the city and county code for your address. These codes can be found at

Jefferson City MO 65105-0840

7. Enter the taxable purchases for each reporting location during the tax period.

If you require additional information regarding consumer’s use tax, please e-mail

Enter zero if you made no taxable purchases at a location during the tax period.

salesuse@dor.mo.gov or call (573) 751-2836. Speech and hearing impaired may use TDD

(800) 735-2966 or fax (573) 526-1881.

The use tax rates may be found on the internet at Use the “USE RATE” column to ensure correct rates.

(12-2012)

1

1