Gross Receipts Tax Amnesty Form

Download a blank fillable Gross Receipts Tax Amnesty Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Gross Receipts Tax Amnesty Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

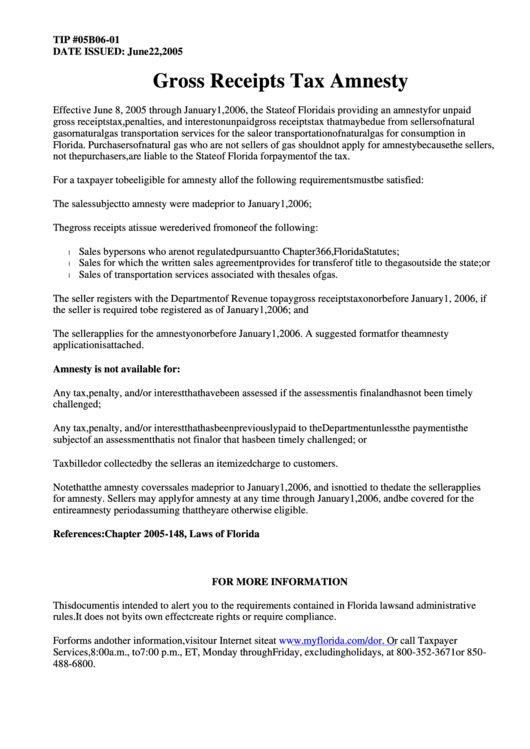

TIP # 05B06-01

DATE ISSUED: June 22, 2005

Gross Receipts Tax Amnesty

Effective June 8, 2005 through January 1, 2006, the State of Florida is providing an amnesty for unpaid

gross receipts tax, penalties, and interest on unpaid gross receipts tax that may be due from sellers of natural

gas or natural gas transportation services for the sale or transportation of natural gas for consumption in

Florida. Purchasers of natural gas who are not sellers of gas should not apply for amnesty because the sellers,

not the purchasers, are liable to the State of Florida for payment of the tax.

For a taxpayer to be eligible for amnesty all of the following requirements must be satisfied:

The sales subject to amnesty were made prior to January 1, 2006;

The gross receipts at issue were derived from one of the following:

Sales by persons who are not regulated pursuant to Chapter 366, Florida Statutes;

l

Sales for which the written sales agreement provides for transfer of title to the gas outside the state; or

l

Sales of transportation services associated with the sales of gas.

l

The seller registers with the Department of Revenue to pay gross receipts tax on or before January 1, 2006, if

the seller is required to be registered as of January 1, 2006; and

The seller applies for the amnesty on or before January 1, 2006. A suggested format for the amnesty

application is attached.

Amnesty is not available for:

Any tax, penalty, and/or interest that have been assessed if the assessment is final and has not been timely

challenged;

Any tax, penalty, and/or interest that has been previously paid to the Department unless the payment is the

subject of an assessment that is not final or that has been timely challenged; or

Tax billed or collected by the seller as an itemized charge to customers.

Note that the amnesty covers sales made prior to January 1, 2006, and is not tied to the date the seller applies

for amnesty. Sellers may apply for amnesty at any time through January 1, 2006, and be covered for the

entire amnesty period assuming that they are otherwise eligible.

References: Chapter 2005-148, Laws of Florida

FOR MORE INFORMATION

This document is intended to alert you to the requirements contained in Florida laws and administrative

rules. It does not by its own effect create rights or require compliance.

For forms and other information, visit our Internet site at Or call Taxpayer

Services, 8:00 a.m., to 7:00 p.m., ET, Monday through Friday, excluding holidays, at 800-352-3671 or 850-

488-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2