Form 8874-A - Notice Of Qualified Equity Investment For New Markets Credit Form

ADVERTISEMENT

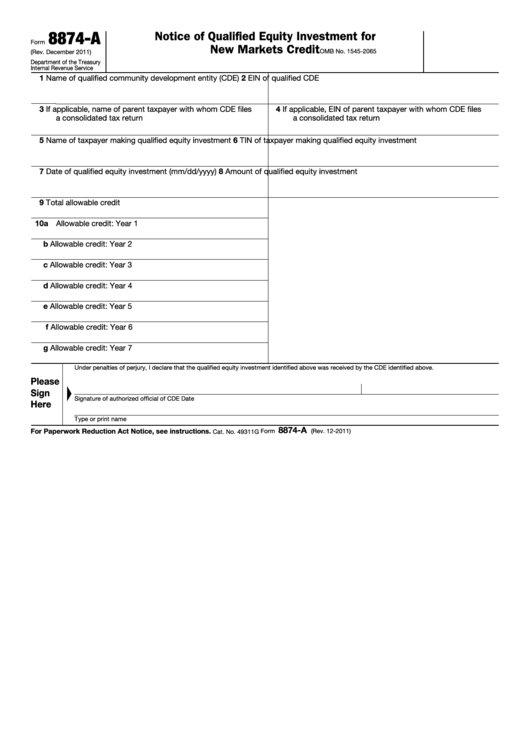

8874-A

Notice of Qualified Equity Investment for

Form

New Markets Credit

OMB No. 1545-2065

(Rev. December 2011)

Department of the Treasury

Internal Revenue Service

1

Name of qualified community development entity (CDE)

2

EIN of qualified CDE

3

If applicable, name of parent taxpayer with whom CDE files

4

If applicable, EIN of parent taxpayer with whom CDE files

a consolidated tax return

a consolidated tax return

5

Name of taxpayer making qualified equity investment

6

TIN of taxpayer making qualified equity investment

7

Date of qualified equity investment (mm/dd/yyyy)

8

Amount of qualified equity investment

9

Total allowable credit

10a Allowable credit: Year 1

b Allowable credit: Year 2

c Allowable credit: Year 3

d Allowable credit: Year 4

e Allowable credit: Year 5

f Allowable credit: Year 6

g Allowable credit: Year 7

Under penalties of perjury, I declare that the qualified equity investment identified above was received by the CDE identified above.

Please

Sign

Signature of authorized official of CDE

Date

Here

Type or print name

8874-A

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2011)

Cat. No. 49311G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1