Form Dr 1481 - Heavy Truck Sales Tax Return

ADVERTISEMENT

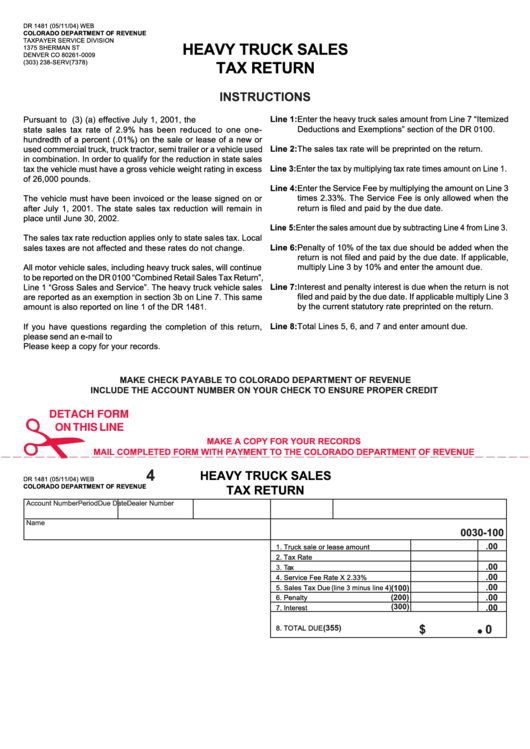

DR 1481 (05/11/04) WEB

COLORADO DEPARTMENT OF REVENUE

TAXPAYER SERVICE DIVISION

HEAVY TRUCK SALES

1375 SHERMAN ST

DENVER CO 80261-0009

(303) 238-SERV(7378)

TAX RETURN

INSTRUCTIONS

Line 1:Enter the heavy truck sales amount from Line 7 “Itemized

Pursuant to C.R.S. 39-26-106 (3) (a) effective July 1, 2001, the

Deductions and Exemptions” section of the DR 0100.

state sales tax rate of 2.9% has been reduced to one one-

hundredth of a percent (.01%) on the sale or lease of a new or

Line 2:The sales tax rate will be preprinted on the return.

used commercial truck, truck tractor, semi trailer or a vehicle used

in combination. In order to qualify for the reduction in state sales

Line 3: Enter the tax by multiplying tax rate times amount on Line 1.

tax the vehicle must have a gross vehicle weight rating in excess

of 26,000 pounds.

Line 4:Enter the Service Fee by multiplying the amount on Line 3

times 2.33%. The Service Fee is only allowed when the

The vehicle must have been invoiced or the lease signed on or

after July 1, 2001. The state sales tax reduction will remain in

return is filed and paid by the due date.

place until June 30, 2002.

Line 5: Enter the sales amount due by subtracting Line 4 from Line 3.

The sales tax rate reduction applies only to state sales tax. Local

Line 6:Penalty of 10% of the tax due should be added when the

sales taxes are not affected and these rates do not change.

return is not filed and paid by the due date. If applicable,

multiply Line 3 by 10% and enter the amount due.

All motor vehicle sales, including heavy truck sales, will continue

to be reported on the DR 0100 “Combined Retail Sales Tax Return”,

Line 7:Interest and penalty interest is due when the return is not

Line 1 “Gross Sales and Service”. The heavy truck vehicle sales

filed and paid by the due date. If applicable multiply Line 3

are reported as an exemption in section 3b on Line 7. This same

amount is also reported on line 1 of the DR 1481.

by the current statutory rate preprinted on the return.

Line 8:Total Lines 5, 6, and 7 and enter amount due.

If you have questions regarding the completion of this return,

please send an e-mail to taxadministration@spike.dor.state.co.us

Please keep a copy for your records.

MAKE CHECK PAYABLE TO COLORADO DEPARTMENT OF REVENUE

INCLUDE THE ACCOUNT NUMBER ON YOUR CHECK TO ENSURE PROPER CREDIT

DETACH FORM

ON THIS LINE

MAKE A COPY FOR YOUR RECORDS

MAIL COMPLETED FORM WITH PAYMENT TO THE COLORADO DEPARTMENT OF REVENUE

4

HEAVY TRUCK SALES

DR 1481 (05/11/04) WEB

COLORADO DEPARTMENT OF REVENUE

TAX RETURN

Account Number

Period

Due Date

Dealer Number

Name

0030-100

.00

1. Truck sale or lease amount

2. Tax Rate

.00

3.

Tax

.00

4. Service Fee Rate X 2.33%

.00

5. Sales Tax Due (line 3 minus line 4)

(100)

.00

(200)

6. Penalty

(300)

.00

7. Interest

$

00

(355)

8. TOTAL DUE

•

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1