Form Dor-587 - Instructions For Schedule Of Distributor Disbursements February 2011

ADVERTISEMENT

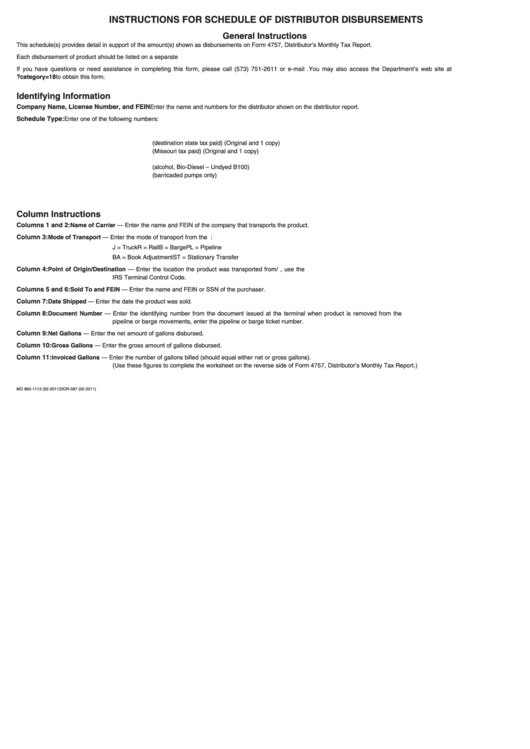

INSTRUCTIONS FOR SCHEDULE OF DISTRIBUTOR DISBURSEMENTS

General Instructions

This schedule(s) provides detail in support of the amount(s) shown as disbursements on Form 4757, Distributor’s Monthly Tax Report.

Each disbursement of product should be listed on a separate line. Complete a separate schedule for each product type.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov. You may also access the Department’s web site at

to obtain this form.

Identifying Information

Company Name, License Number, and FEIN

Enter the name and numbers for the distributor shown on the distributor report.

Schedule Type:

Enter one of the following numbers:

5.

Gallons of dyed fuel sold for taxable purposes

5W.

Gallons of tax-exempt product blended tax and fees unpaid

7A.

Gallons exported to state of _______________ (destination state tax paid) (Original and 1 copy)

7B.

Gallons exported to state of _______________ (Missouri tax paid) (Original and 1 copy)

10A.

Gallons of tax-exempt product blended fees unpaid

10G.

Gallons of other authorized tax-exempt sales (alcohol, Bio-Diesel – Undyed B100)

10J.

Gallons of clear kerosene delivered to filling stations (barricaded pumps only)

10K.

Gallons delivered to airlines

10R.

Gallons delivered for use as bunker fuel in vessels

10Y.

Gallons delivered to railroads

Column Instructions

Columns 1 and 2:

Name of Carrier — Enter the name and FEIN of the company that transports the product.

Column 3:

Mode of Transport — Enter the mode of transport from the terminal. Use one of the following:

J = Truck

R = Rail

B = Barge

PL = Pipeline

BA = Book Adjustment

ST = Stationary Transfer

Column 4:

Point of Origin/Destination — Enter the location the product was transported from/to. When disbursements are received from a terminal, use the

IRS Terminal Control Code.

Columns 5 and 6:

Sold To and FEIN — Enter the name and FEIN or SSN of the purchaser.

Column 7:

Date Shipped — Enter the date the product was sold.

Column 8:

Document Number — Enter the identifying number from the document issued at the terminal when product is removed from the rack. In case of

pipeline or barge movements, enter the pipeline or barge ticket number.

Column 9:

Net Gallons — Enter the net amount of gallons disbursed.

Column 10:

Gross Gallons — Enter the gross amount of gallons disbursed.

Column 11:

Invoiced Gallons — Enter the number of gallons billed (should equal either net or gross gallons).

(Use these figures to complete the worksheet on the reverse side of Form 4757, Distributor’s Monthly Tax Report.)

MO 860-1113 (02-2011)

DOR-587 (02-2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1