Form Rpd-41318 - Application For Refund Of Tobacco Products Tax - 2011

ADVERTISEMENT

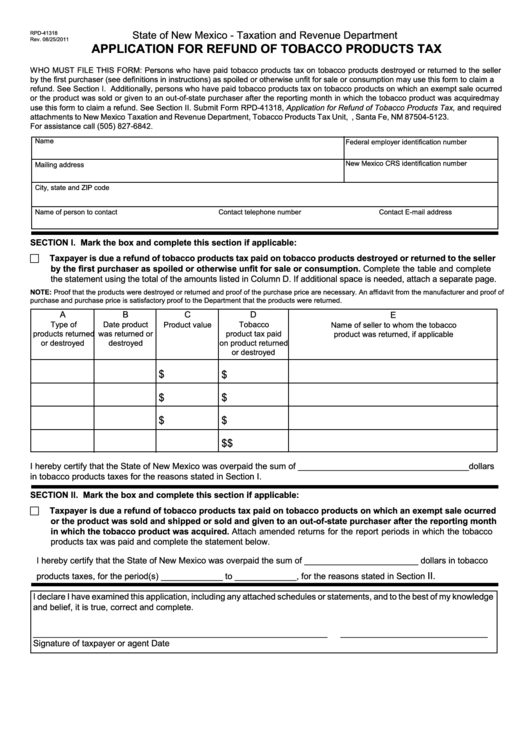

State of New Mexico - Taxation and Revenue Department

RPD-41318

Rev. 08/25/2011

APPLICATION FOR REFUND OF TOBACCO PRODUCTS TAX

WHO MUST FILE THIS FORM: Persons who have paid tobacco products tax on tobacco products destroyed or returned to the seller

by the first purchaser (see definitions in instructions) as spoiled or otherwise unfit for sale or consumption may use this form to claim a

refund. See Section I. Additionally, persons who have paid tobacco products tax on tobacco products on which an exempt sale ocurred

or the product was sold or given to an out-of-state purchaser after the reporting month in which the tobacco product was acquired may

use this form to claim a refund. See Section II. Submit Form RPD-41318, Application for Refund of Tobacco Products Tax, and required

attachments to New Mexico Taxation and Revenue Department, Tobacco Products Tax Unit, P.O. Box 25123, Santa Fe, NM 87504-5123.

For assistance call (505) 827-6842.

Name

Federal employer identification number

New Mexico CRS identification number

Mailing address

City, state and ZIP code

Name of person to contact

Contact telephone number

Contact E-mail address

SECTION I. Mark the box and complete this section if applicable:

c Taxpayer is due a refund of tobacco products tax paid on tobacco products destroyed or returned to the seller

by the first purchaser as spoiled or otherwise unfit for sale or consumption. Complete the table and complete

the statement using the total of the amounts listed in Column D. If additional space is needed, attach a separate page.

NOTE: Proof that the products were destroyed or returned and proof of the purchase price are necessary. An affidavit from the manufacturer and proof of

purchase and purchase price is satisfactory proof to the Department that the products were returned.

A

B

C

D

E

Type of

Date product

Tobacco

Name of seller to whom the tobacco

Product value

products returned

was returned or

product tax paid

product was returned, if applicable

or destroyed

destroyed

on product returned

or destroyed

$

$

$

$

$

$

$

$

I hereby certify that the State of New Mexico was overpaid the sum of ____________________________________dollars

in tobacco products taxes for the reasons stated in Section I.

SECTION II. Mark the box and complete this section if applicable:

c Taxpayer is due a refund of tobacco products tax paid on tobacco products on which an exempt sale ocurred

or the product was sold and shipped or sold and given to an out-of-state purchaser after the reporting month

in which the tobacco product was acquired. Attach amended returns for the report periods in which the tobacco

products tax was paid and complete the statement below.

I hereby certify that the State of New Mexico was overpaid the sum of ________________________ dollars in tobacco

II.

products taxes, for the period(s) _____________ to _____________, for the reasons stated in Section

I declare I have examined this application, including any attached schedules or statements, and to the best of my knowledge

and belief, it is true, correct and complete.

______________________________________________________________

_______________________________

Signature of taxpayer or agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2