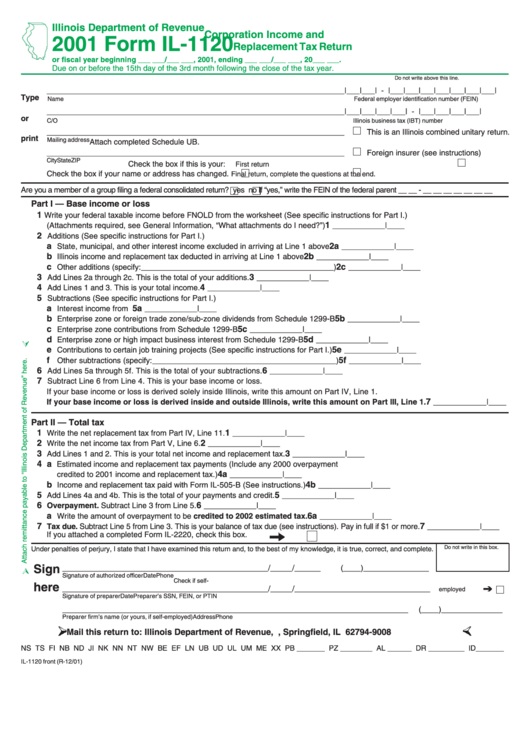

Form Il-1120 - Corporation Income And Replacement Tax Return - 2001

ADVERTISEMENT

Illinois Department of Revenue

Corporation Income and

2001 Form IL-1120

Replacement Tax Return

or fiscal year beginning ___ ___/___ ___, 2001, ending ___ ___/___ ___, 20___ ___.

Due on or before the 15th day of the 3rd month following the close of the tax year.

Do not write above this line.

____________________________________________________________________

|___|___| - |___|___|___|___|___|___|___|

Type

Name

Federal employer identification number (FEIN)

____________________________________________________________________

|___|___|___|___| - |___|___|___|___|

or

C/O

Illinois business tax (IBT) number

____________________________________________________________________

This is an Illinois combined unitary return.

print

Mailing address

Attach completed Schedule UB.

____________________________________________________________________

Foreign insurer (see instructions)

City

State

ZIP

Check the box if this is your:

First return

Check the box if your name or address has changed.

.

Final return, complete the questions at the end

Are you a member of a group filing a federal consolidated return?

yes

no If “yes,” write the FEIN of the federal parent __ __ - __ __ __ __ __ __ __

Part I — Base income or loss

1

Write your federal taxable income before FNOLD from the worksheet (See specific instructions for Part I.)

1

(Attachments required, see General Information, “What attachments do I need?”)

____________|____

2

Additions (See specific instructions for Part I.)

a

2a

State, municipal, and other interest income excluded in arriving at Line 1 above

____________|____

b

2b

Illinois income and replacement tax deducted in arriving at Line 1 above

____________|____

c

2c

Other additions (specify:____________________________________________)

____________|____

3

3

Add Lines 2a through 2c. This is the total of your additions.

____________|____

4

4

Add Lines 1 and 3. This is your total income.

____________|____

5

Subtractions (See specific instructions for Part I.)

a

5a

Interest income from U.S. Treasury and other exempt federal obligations

____________|____

b

5b

Enterprise zone or foreign trade zone/sub-zone dividends from Schedule 1299-B

____________|____

c

5c

Enterprise zone contributions from Schedule 1299-B

____________|____

d

5d

Enterprise zone or high impact business interest from Schedule 1299-B

____________|____

e

5e

Contributions to certain job training projects (See specific instructions for Part I.)

____________|____

f

5f

Other subtractions (specify:__________________________________________)

____________|____

6

6

Add Lines 5a through 5f. This is the total of your subtractions.

____________|____

7

Subtract Line 6 from Line 4. This is your base income or loss.

If your base income or loss is derived solely inside Illinois, write this amount on Part IV, Line 1.

7

If your base income or loss is derived inside and outside Illinois, write this amount on Part III, Line 1.

____________|____

Part II — Total tax

1

1

Write the net replacement tax from Part IV, Line 11.

____________|____

2

2

Write the net income tax from Part V, Line 6.

____________|____

3

3

Add Lines 1 and 2. This is your total net income and replacement tax.

____________|____

4 a

Estimated income and replacement tax payments (Include any 2000 overpayment

4a

credited to 2001 income and replacement tax.)

____________|____

b

4b

Income and replacement tax paid with Form IL-505-B (See instructions.)

____________|____

5

5

Add Lines 4a and 4b. This is the total of your payments and credit.

____________|____

6

6

Overpayment. Subtract Line 3 from Line 5.

____________|____

a

6a

Write the amount of overpayment to be credited to 2002 estimated tax.

____________|____

7

7

Tax due. Subtract Line 5 from Line 3. This is your balance of tax due (see instructions). Pay in full if $1 or more.

____________|____

If you attached a completed Form IL-2220, check this box.

Do not write in this box.

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign

_______________________________________________/_____/______

(____)_______________

Signature of authorized officer

Date

Phone

Check if self-

here

_______________________________________________/_____/______

_________________________

employed

Signature of preparer

Date

Preparer’s SSN, FEIN, or PTIN

_______________________________

________________________________________________

(____)______________

Preparer firm’s name (or yours, if self-employed)

Address

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19008, Springfield, IL 62794-9008

NS TS FI NB ND JI NK NN NT NW BE EF LN UB UD UL UM ME XX PB _______ PZ ________ AL ______ DR _________ ID_______

IL-1120 front (R-12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2