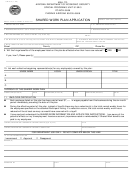

Form Uc700 - Unemployment Insurance Tax Rate Calculation - Arizona Department Of Economic Security Page 2

ADVERTISEMENT

* * * * *

Arizona has experienced impressive business growth during the past decade! By June 30, 2002, Arizona had grown to

112,501 active employer accounts compared to 81,079 active employers as of June 30, 1992.

BENEFIT CHARGES AND

YOUR FUTURE TAX RATE

When a former employee files for unemployment insurance benefits, and your unemployment insurance account is

charged, the end result could be an increase in your tax rate for the coming year.

After an individual has filed a claim, you are sent a notice (form UB-110 “Notice to Employer”) informing you that a former

employee has filed for unemployment insurance benefits. If the claimant separated from your employ for any reason

other than a lack of work (layoff), the notice gives you the opportunity to protest charges to your account. Relief of

charges does not apply to non-profit, governmental agencies, and Indian tribes that have chosen to make payments on a

claim-by-claim basis (called “reimbursable employers”) instead of paying taxes.

It is important that you complete and return the “Notice to Employer” form within ten (10) working days if you wish to

protest payment of benefits and charges to your account. If you do not return this form, and the claimant is found

eligible for benefits, your account will be charged and no further appeal rights will be provided.

APPEALS CLOCK DOES NOT KEEP TICKING!

Nothing lasts forever. This cliché is especially true for the time allowed to file an appeal after a determination or

assessment is issued.

For the employer’s protection, the law mandates a 15-day appeal period. The clock starts ticking on the date postmarked

on the envelope in which the determination or assessment was mailed to the employer. Fifteen calendar days later the

clock stops ticking and all legal right to review is lost!

An appeal is a valuable legal right. In most cases, the filing of an appeal equates to a referee blowing a whistle for a time-

out.

The clock stops. In the Unemployment Insurance Tax system, an appeal signals that the employer wants a

reconsideration, rate recalculation, reassessment, or reclassification.

However, such “re-do’s” cannot occur unless the employer takes the time to write and mail or fax their appeal. An appeal

MUST be made in writing and filed within the time limits allowed by law.

For more information on protecting your rights as an employer, please review the section about appeals on the

Employment Security Administration UI Tax website at: Look for “UI Tax

Appeals” under “Employer Information”.

FRAUD IS EXPENSIVE

Unemployment Insurance fraud costs employers directly in the form of higher taxes!

When a claimant receives

unemployment benefits but continues to work, it cheats every employer who is forced to pay for those benefits with higher

taxes.

During the second quarter of 2002, there were 98 individuals convicted for unemployment benefits fraud. Collectively,

they received the following sentences:

•

Nine years, three months total jail time

•

$293,744 in fines/restitution ($1,158,700 YTD)

•

203.33 years probation

•

7,290 hours Community Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3