Form Uc700 - Arizona Department Of Economic Security - Unemployment Insurance - Employer Newsletter - January 2003 Page 2

ADVERTISEMENT

COMING SOON . . .

Convenience and security will soon be extended to employers when the Employment Security Administration’s online

filing project for Unemployment Tax and Wage Reports is completed later this year.

All registered rated and reimbursable employers currently paying wages in Arizona will be eligible to file wage reports

online. Certain changes to employers’ accounts will also be accepted. Future enhancements to the Internet wage filing

process will include online payment options and electronic funds transfers. After further development, employers will

also be able to register a new business with DES or report when a business has been sold or transferred.

Watch for notification when online wage reporting becomes available this year!

DES is working hard to provide customers with a more effective and efficient method of conducting business. Internet

filing options will provide quality services to workers and employers alike.

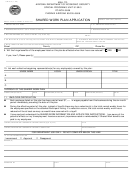

USE THE CORRECT TAX RATE

Unemployment Insurance Tax Rate Notices for the new year were mailed on January 3rd to all active employers

operating and paying wages in Arizona. The Rate Notice provides the UI Tax Rate to be used in calculating, reporting

and paying 2003 Unemployment Insurance taxes, as well as whether a business is liable for the Job Training Tax.

Each employer should receive the Rate Notice no later than mid-January. If your business does not receive a Rate

Notice by then, please contact the Employer Experience Rating Unit at (602) 248-9101 extension 5501.

If you do not receive a Rate Notice, it may also be necessary to update your business account information on file with

the

Department.

The

Report

of

Changes

form

is

available

on

the

UI

Tax

website

at:

The 2003 tax rate is also preprinted on the Tax and Wage Report blank form mailed to employers in March for the First

Quarter reports due by April 30. Please take care to use the rate indicated in Line #4 when computing the amount of

tax due on Line #3.

If your business uses a payroll or reporting software instead of the preprinted Report forms, you must reprogram the

software with the correct tax rate as provided in the Rate Notice or on the preprinted Tax and Wage Report form. You

must also program for the Job Training Tax (JTT) found on Line #7 of the form.

If you do not use the correct tax rate, your Reports will not be correct and your business will either overpay or underpay

taxes due. An underpayment of taxes can cost your business underpayment penalties, so be sure to use the

correct rate.

VOLUNTARY TAX PAYMENTS

Remember that it may be possible for you to lower your assigned Unemployment Insurance Tax Rate by making a

Voluntary Tax Payment.

Included with the Rate Notice is an explanation about how to calculate the amount you can pay to improve your reserve

ratio and thereby lower your tax rate. By comparing the voluntary payment amount with your potential reduction in

taxes, you can determine if you will save money by making a voluntary payment.

A Voluntary Payment must be postmarked no later than January 31, 2003 in order to lower your rate for the

current year.

NEW ADDRESS FOR THE EMPLOYMENT

SECURITY ADMINISTRATION WEBSITE

Due to ongoing development, the DES Employment Security Administration website address is now:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3