Form Uc-700 - Employer Newsletter - Arizona Department Of Economic Security Unemployment Insurance - October 2000 Page 2

ADVERTISEMENT

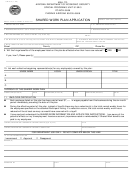

NEW HIRE REPORTING

In last quarter's newsletter, you were introduced to Arizona's New Hire Reporting Program. This quarter, we would like to

provide you with information to assist you in reporting your new hires.

Whom do I report?

A.R.S. 23.722.01 requires that all new hires, and re-hires, must be reported within 20 days of hire.

What do I need to report?

The following data must be reported:

Employee Information

Employer Information

Employee's Name

Employer's Name

Employee's Address

Employer's Address

Social Security Number

Federal Employer ID (FEIN)

How do I report?

We offer a variety of reporting options. Please visit our website for more information on how to report, to download a New

Hire Reporting Form, or to report on-line. You can also call our toll free number and request documents through our fax-

on-demand system 24 hours a day.

The Arizona New Hire Reporting Program is a valuable asset to our community. Please help us in supporting Arizona's

children.

Website

Toll free customer contact

line & fax back information

888-282-2064

FRAUD CONVICTIONS IN MARICOPA COUNTY

The Department's Office of Special Investigations (OSI) uses quarterly reports of fraud convictions to provide feedback to

benefit programs. The Unemployment Insurance report is a testimonial to the overall efforts of everyone from line

personnel to you, the employer.

Statewide Unemployment Insurance fraud convictions of sixty-six individuals during the second quarter of 2000 have lead

to restitution orders and fines of $161,076, prison sentences totaling 10 years, probation periods adding up to 116 years

and community service of 3,635 hours.

UI BENEFITS TO DISCHARGED EMPLOYEES

Are you thinking of discharging an employee for misconduct?

Many employers, although they have good cause for discharging an employee, do not keep adequate records to

substantiate good cause for the discharge. This is a common problem throughout the employer community.

When you discharge an employee and protest the payment of Unemployment Insurance benefits, it is your responsibility

to provide supporting evidence to justify the discharge.

Here is a reminder list of some of the most overlooked information needed in the employee's personnel file.

1.

Keep records of all misconduct including dates, witnesses and specifically, what the employee did wrong.

2.

Keep accurate records of all warnings both verbal and written, including when warned, who did the warning and

why the employee was warned.

3.

The employer also needs to have an accurate statement of the final incident that caused the employee to be

discharged including when, why and any witnesses to the event.

Inaccurate and incomplete employee records are common reasons why employers do not receive favorable rulings when

protesting an Unemployment Insurance claim.

CHANGE THE E-MAIL ADDRESS

General questions concerning Unemployment Insurance Tax laws, rules, regulations or UI Tax Administration can be

referred to the UI Tax Program Specialist at the new e-mail address of wdent@mail.de.state.az.us.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4