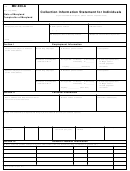

Part H: Analyze your monthly income and expenses

Income

Necessary monthly living expenses

A

B

C

A

B

Source

Gross

Net

Expense

Amount

67

78

Your wages or salary

___________________

___________________

Rent (not included

68

Your spouse’s

in Part G, Line 59)

___________________

79

wages or salary

___________________

___________________

Groceries

69

Interest or dividends

___________________

___________________

(number of people____)

___________________

70

80

Business income

___________________

___________________

Installment pmts. from

71

Rental income

___________________

___________________

Part G, Line 66, Col. E

___________________

72

81

Your pension

___________________

___________________

Utilities

a gas

___________________

73

Your spouse’s pension

___________________

___________________

b water

___________________

74

Child support

___________________

___________________

c electric

___________________

75

Alimony

___________________

___________________

d telephone

___________________

76

82

Other (specify)

Transportation

___________________

83

________________

___________________

___________________

Insurance a life

___________________

________________

___________________

___________________

(monthly

b health

___________________

________________

___________________

___________________

premiums) c home

___________________

________________

___________________

___________________

d car

___________________

84

________________

___________________

___________________

Medical (not covered

________________

___________________

___________________

in Line 83b above)

___________________

85

________________

___________________

___________________

Estimated tax payments

___________________

86

________________

___________________

___________________

Court-ordered payments

___________________

87

________________

___________________

___________________

Other (specify)

________________

___________________

___________________

__________________

___________________

________________

___________________

___________________

__________________

___________________

________________

___________________

___________________

__________________

___________________

88

Add Lines 78 through 87.

77

Add Lines 67 through 76, Column C.

This amount is your

This amount is your total net income.

____________________

total expenses.

___________________

89

89

Subtract Line 88 from Line 77. This amount is your net income after expenses.

___________________

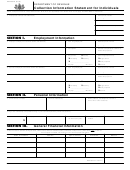

Part I: Complete any additional asset or income information

90

Write any additional information you have about your assets or income that was not included in any of the preceding parts. Be sure to

include a statement regarding the prospect of any increase in the value of your assets or your present income.

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Section 3: Sign below

Under penalties of perjury, I state that I have examined this statement of assets, liabilities, and other information and, to the best of my

knowledge, it is true, correct, and complete.

______________________________________________/___/_____

______________________________________________/___/_____

Petitioner’s signature (not representative)

Date

Spouse’s signature

Date

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

could result in this form not being processed. This form has been approved by the Forms Management Center.

IL-492-3683

Page 4 of 4

BOA-4 (R-4/01)

Reset

Print

1

1 2

2 3

3 4

4