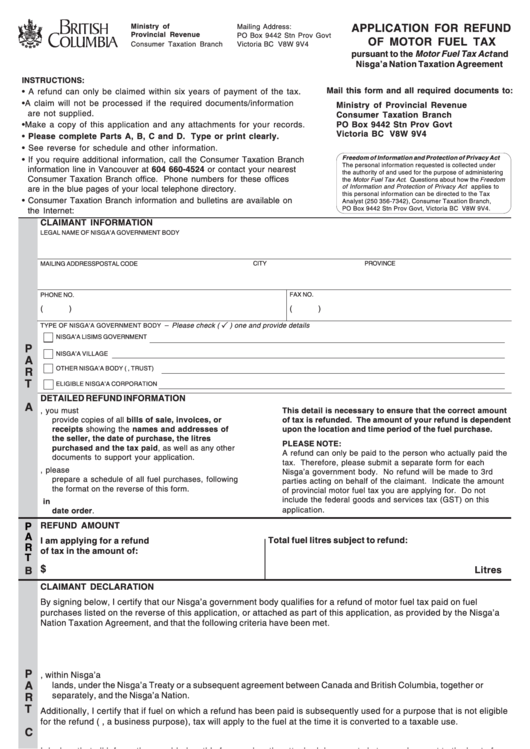

Ministry of

Mailing Address:

APPLICATION FOR REFUND

Provincial Revenue

PO Box 9442 Stn Prov Govt

OF MOTOR FUEL TAX

Consumer Taxation Branch

Victoria BC V8W 9V4

pursuant to the Motor Fuel Tax Act and

Nisga’a Nation Taxation Agreement

INSTRUCTIONS:

Mail this form and all required documents to:

• A refund can only be claimed within six years of payment of the tax.

• A claim will not be processed if the required documents/information

Ministry of Provincial Revenue

are not supplied.

Consumer Taxation Branch

PO Box 9442 Stn Prov Govt

• Make a copy of this application and any attachments for your records.

Victoria BC V8W 9V4

• Please complete Parts A, B, C and D. Type or print clearly.

• See reverse for schedule and other information.

Freedom of Information and Protection of Privacy Act

• If you require additional information, call the Consumer Taxation Branch

The personal information requested is collected under

information line in Vancouver at 604 660-4524 or contact your nearest

the authority of and used for the purpose of administering

Consumer Taxation Branch office. Phone numbers for these offices

the Motor Fuel Tax Act . Questions about how the Freedom

of Information and Protection of Privacy Act applies to

are in the blue pages of your local telephone directory.

this personal information can be directed to the Tax

• Consumer Taxation Branch information and bulletins are available on

Analyst (250 356-7342), Consumer Taxation Branch,

PO Box 9442 Stn Prov Govt, Victoria BC V8W 9V4.

the Internet:

CLAIMANT INFORMATION

LEGAL NAME OF NISGA’A GOVERNMENT BODY

MAILING ADDRESS

CITY

PROVINCE

POSTAL CODE

FAX NO.

PHONE NO.

(

)

(

)

– Please check (

) one and provide details

TYPE OF NISGA’A GOVERNMENT BODY

NISGA’A LISIMS GOVERNMENT

P

NISGA’A VILLAGE

A

OTHER NISGA’A BODY (e.g., TRUST)

R

T

ELIGIBLE NISGA’A CORPORATION

DETAILED REFUND INFORMATION

A

1. In support of your refund application, you must

This detail is necessary to ensure that the correct amount

provide copies of all bills of sale, invoices, or

of tax is refunded. The amount of your refund is dependent

receipts showing the names and addresses of

upon the location and time period of the fuel purchase.

the seller, the date of purchase, the litres

PLEASE NOTE:

purchased and the tax paid, as well as any other

A refund can only be paid to the person who actually paid the

documents to support your application.

tax. Therefore, please submit a separate form for each

2. If your claim contains more than one invoice, please

Nisga’a government body. No refund will be made to 3rd

prepare a schedule of all fuel purchases, following

parties acting on behalf of the claimant. Indicate the amount

the format on the reverse of this form.

of provincial motor fuel tax you are applying for. Do not

include the federal goods and services tax (GST) on this

3. Ensure that invoices within each section are listed in

application.

date order.

REFUND AMOUNT

P

A

I am applying for a refund

Total fuel litres subject to refund:

R

of tax in the amount of:

T

$

B

Litres

CLAIMANT DECLARATION

By signing below, I certify that our Nisga’a government body qualifies for a refund of motor fuel tax paid on fuel

purchases listed on the reverse of this application, or attached as part of this application, as provided by the Nisga’a

Nation Taxation Agreement, and that the following criteria have been met.

1. The fuel was purchased or consumed within the Province of British Columbia.

2. The fuel was not acquired for consumption or use in the course of a business or other activity for profit or gain.

P

3. Substantially all of the fuel was consumed or used in respect of performing a function of government, within Nisga’a

A

lands, under the Nisga’a Treaty or a subsequent agreement between Canada and British Columbia, together or

separately, and the Nisga’a Nation.

R

T

Additionally, I certify that if fuel on which a refund has been paid is subsequently used for a purpose that is not eligible

for the refund (i.e., a business purpose), tax will apply to the fuel at the time it is converted to a taxable use.

C

I declare that all information provided on this form and on the attached documents is true and correct to the best of my

knowledge and belief. I acknowledge that any false information may result in prosecution, a fine up to $10,000, and/or

imprisonment for up to two years.

– Please type or print

CLAIMANT NAME

ORGANIZATION POSITION / TITLE

SIGNATURE

DATE SIGNED

YYYY

MM

DD

X

FIN 413/NNMFT/WEB Rev. 2001 / 8 / 16

1

1 2

2