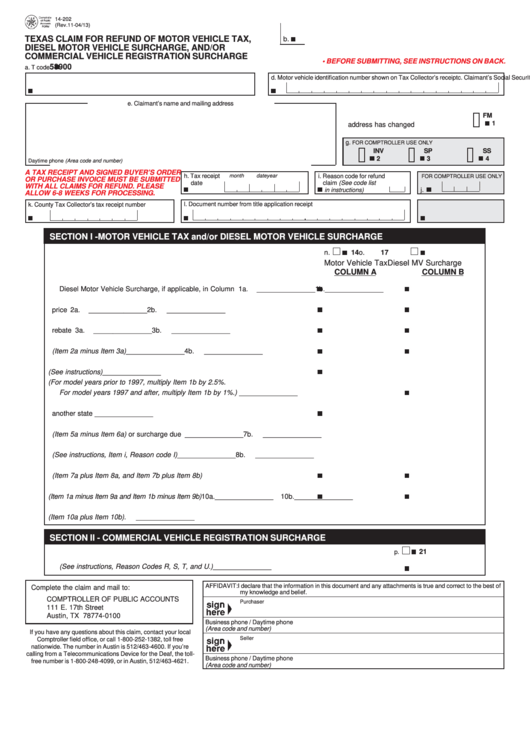

14-202

(Rev.11-04/13)

TEXAS CLAIM FOR REFUND OF MOTOR VEHICLE TAX,

b.

DIESEL MOTOR VEHICLE SURCHARGE, AND/OR

COMMERCIAL VEHICLE REGISTRATION SURCHARGE

• BEFORE SUBMITTING, SEE INSTRUCTIONS ON BACK.

58900

a. T code

c. Claimant’s Social Security or FEI number

d. Motor vehicle identification number shown on Tax Collector’s receipt

e. Claimant’s name and mailing address

FM

f. Blacken this box if your

1

address has changed ...........................

g.

FOR COMPTROLLER USE ONLY

INV

SP

SS

2

3

4

Daytime phone (Area code and number)

A TAX RECEIPT AND SIGNED BUYER’S ORDER

month

date

year

h. Tax receipt

i. Reason code for refund

FOR COMPTROLLER USE ONLY

OR PURCHASE INVOICE MUST BE SUBMITTED

date

claim (See code list

WITH ALL CLAIMS FOR REFUND. PLEASE

in instructions)

j.

ALLOW 6-8 WEEKS FOR PROCESSING.

l. Document number from title application receipt

k. County Tax Collector’s tax receipt number

m.PM

SECTION I - MOTOR VEHICLE TAX and/or DIESEL MOTOR VEHICLE SURCHARGE

n.

14

o.

17

Motor Vehicle Tax

Diesel MV Surcharge

COLUMN A

COLUMN B

1. Amount of motor vehicle tax / penalty paid to Texas in Column A and

Diesel Motor Vehicle Surcharge, if applicable, in Column B ................................. 1a.

_______________

1b.

_______________

2. Motor vehicle sales price ........................................................................................ 2a.

_______________

2b.

_______________

3. Trade-in or rebate ................................................................................................... 3a.

_______________

3b.

_______________

4. Taxable value (Item 2a minus Item 3a) .................................................................. 4a.

_______________

4b.

_______________

5a. Motor vehicle tax due (See instructions) ................................................................ 5a.

_______________

5b. Diesel motor vehicle surcharge due (For model years prior to 1997, multiply Item 1b by 2.5%.

For model years 1997 and after, multiply Item 1b by 1%.) .................................................................................. 5b.

_______________

6. Tax paid to another state ........................................................................................ 6a.

_______________

7. Amount of tax due (Item 5a minus Item 6a) or surcharge due .............................. 7a.

_______________

7b.

_______________

8. Amount of penalty if due (See instructions, Item i, Reason code I) ...................... 8a.

_______________

8b.

_______________

9. Total amount due (Item 7a plus Item 8a, and Item 7b plus Item 8b) ..................... 9a.

_______________

9b.

_______________

10. Amount of refund requested (Item 1a minus Item 9a and Item 1b minus Item 9b) 10a.

_______________

10b.

_______________

11. TOTAL REFUND FOR SECTION I - (Item 10a plus Item 10b) ........................................................................... 11.

_______________

SECTION II - COMMERCIAL VEHICLE REGISTRATION SURCHARGE

21

p.

12. Amount of commercial vehicle registration surcharge refund requested

(See instructions, Reason Codes R, S, T, and U.) .............................................................................................. 12.

_______________

AFFIDAVIT: I declare that the information in this document and any attachments is true and correct to the best of

Complete the claim and mail to:

my knowledge and belief.

COMPTROLLER OF PUBLIC ACCOUNTS

Purchaser

111 E. 17th Street

Austin, TX 78774-0100

Business phone / Daytime phone

(Area code and number)

If you have any questions about this claim, contact your local

Seller

Comptroller field office, or call 1-800-252-1382, toll free

nationwide. The number in Austin is 512/463-4600. If you’re

calling from a Telecommunications Device for the Deaf, the toll-

Business phone / Daytime phone

free number is 1-800-248-4099, or in Austin, 512/463-4621.

(Area code and number)

1

1 2

2