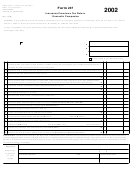

Form A - Premium Tax Return Life Companies - 2014 Page 2

ADVERTISEMENT

Page 2

Col. 1

Col. 2

Life Insurance Premiums

State of

State of Iowa

Incorporation Basis

Basis

10. Life insurance premiums, per Schedule T of the Annual Statement*

$

$

DEDUCTIONS

$

$

11. Dividends paid in cash

12. Dividends applied in reduction of premiums

13. Dividends left to accumulate

14. Premiums (less return premiums) qualified under Sections 401, 403, 404, 408 or 501(a)

of Federal Internal Revenue Code*** (Dividends of $ ____________________________

were paid on qualified premiums.)

XXXX

15. Other (specify)

$

$

16.

Total deductions

17. Net taxable insurance premiums (Item 10 less 16)

$

$

18. Tax at rate of ______% (1% for Iowa)

$

$

Annuity Considerations

19. Annuity Considerations per, Schedule T of the Annual Statement*

$

$

DEDUCTIONS

20. Dividends paid in cash, applied in reduction of premiums, left to accumulate.

$

$

21. Premiums (less return premiums) qualified under Sections 401, 403, 404, 408 or 501(a)

of Federal Internal Revenue Code*** (Dividends of $ ____________________________

were paid on qualified premiums.)

XXXX

22. Other (specify)

23.

Total deductions

$

$

24. Net annuity considerations (Item 19 less 23)

$

$

25. Deduct Remittances received after July 1, 1988**

XXXX

26. Net taxable annuity considerations (Item 24 less 25)

27 Tax at rate of ______% (1% for Iowa)

$

$

$

$

28. Premium tax subtotal (Items 9, 18 and 27)

29. Iowa Life and Health Guarantee Association****

$

$

(do not enter an amount greater than tax on line 28)

30. Iowa Comprehensive Health Insurance Association*****

$

$

(do not enter an amount greater than tax on line 28)

31. Premium tax (Items 28 less items, 29 and 30)

$

$

* In computing premium income or annuities on life policies, returned cash values or lump-sum payments are not to be deducted from the taxable

gross amount. Attorney General's Opinion - March 9, 1951.

**Annuities are taxed pursuant to Chapter 432, Code of Iowa (Applicable to remittances received prior to July 1, 1988).

***A pension, annuity, profit sharing plan or individual retirement annuity qualified or exempt under these sections of the Federal Internal Revenue Code.

****Attach a copy of tax offset notice pursuant to assessment payments made in accordance with 508C.19 Code of Iowa.

*****Attach copies of applicable assessment notices made in accordance with 514E.2(13), Code of Iowa.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3