Form B - Premium Tax Return Other Than Life Companies - 2013

ADVERTISEMENT

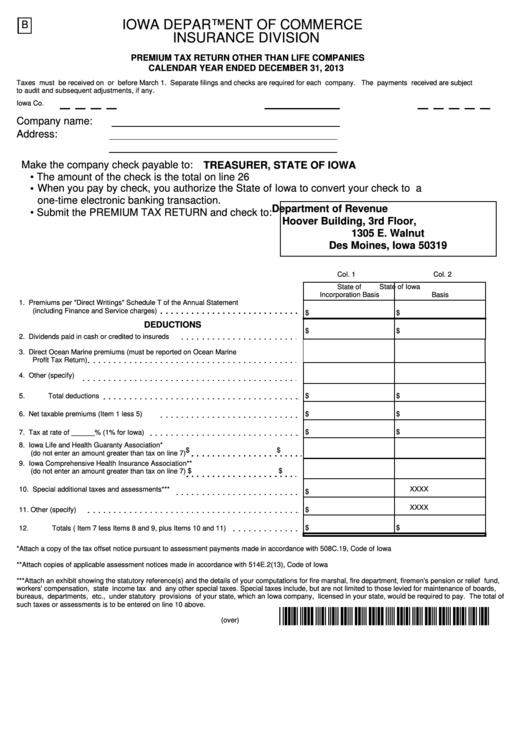

IOWA DEPARTMENT OF COMMERCE

B

INSURANCE DIVISION

PREMIUM TAX RETURN OTHER THAN LIFE COMPANIES

CALENDAR YEAR ENDED DECEMBER 31, 2013

Taxes must be received on or before March 1. Separate filings and checks are required for each company. The payments received are subject

to audit and subsequent adjustments, if any.

Iowa Co. No.

State Of Domicile

NAIC Co. No.

Company name:

Address:

Make the company check payable to:

TREASURER, STATE OF IOWA

• The amount of the check is the total on line 26

When you pay by check, you authorize the State of Iowa to convert your check to a

•

one-time electronic banking transaction.

Department of Revenue

• Submit the PREMIUM TAX RETURN and check to:

Hoover Building, 3rd Floor, P.O. Box 10455

1305 E. Walnut

Des Moines, Iowa 50319

Col. 1

Col. 2

State of

State of Iowa

Incorporation Basis

Basis

1. Premiums per "Direct Writings" Schedule T of the Annual Statement

(including Finance and Service charges)

$

$

DEDUCTIONS

$

$

2. Dividends paid in cash or credited to insureds

3. Direct Ocean Marine premiums (must be reported on Ocean Marine

Profit Tax Return)

4. Other (specify)

$

$

5.

Total deductions

$

$

6. Net taxable premiums (Item 1 less 5)

7. Tax at rate of ______% (1% for Iowa)

$

$

8. Iowa Life and Health Guaranty Association*

$

$

(do not enter an amount greater than tax on line 7)

9. Iowa Comprehensive Health Insurance Association**

$

$

(do not enter an amount greater than tax on line 7)

10. Special additional taxes and assessments***

XXXX

$

XXXX

$

11. Other (specify)

12.

Totals ( Item 7 less Items 8 and 9, plus Items 10 and 11)

$

$

*Attach a copy of the tax offset notice pursuant to assessment payments made in accordance with 508C.19, Code of Iowa

**Attach copies of applicable assessment notices made in accordance with 514E.2(13), Code of Iowa

***Attach an exhibit showing the statutory reference(s) and the details of your computations for fire marshal, fire department, firemen's pension or relief fund,

workers' compensation, state income tax and any other special taxes. Special taxes include, but are not limited to those levied for maintenance of boards,

bureaus, departments, etc., under statutory provisions of your state, which an Iowa company, licensed in your state, would be required to pay. The total of

such taxes or assessments is to be entered on line 10 above.

*1310003010001*

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2