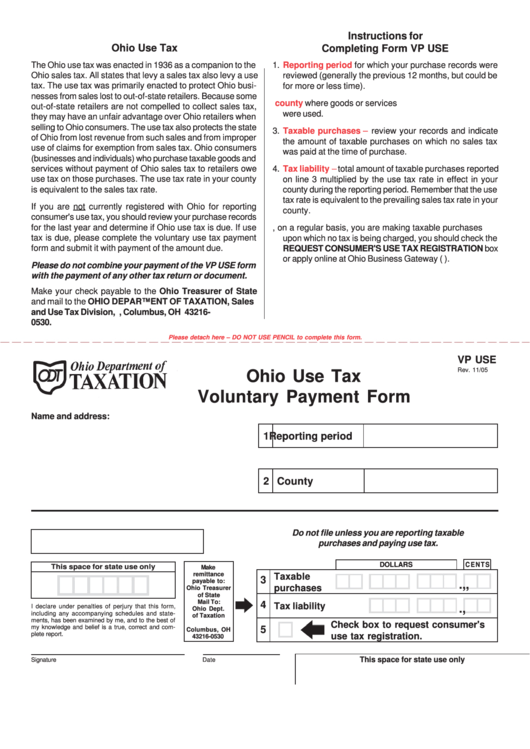

Form Vp Use - Voluntary Payment Form

ADVERTISEMENT

Instructions for

Ohio Use Tax

Completing Form VP USE

The Ohio use tax was enacted in 1936 as a companion to the

1.

Reporting period

for which your purchase records were

Ohio sales tax. All states that levy a sales tax also levy a use

reviewed (generally the previous 12 months, but could be

tax. The use tax was primarily enacted to protect Ohio busi-

for more or less time).

nesses from sales lost to out-of-state retailers. Because some

2. Indicate the name of the

county

where goods or services

out-of-state retailers are not compelled to collect sales tax,

were used.

they may have an unfair advantage over Ohio retailers when

selling to Ohio consumers. The use tax also protects the state

3.

Taxable purchases –

review your records and indicate

of Ohio from lost revenue from such sales and from improper

the amount of taxable purchases on which no sales tax

use of claims for exemption from sales tax. Ohio consumers

was paid at the time of purchase.

(businesses and individuals) who purchase taxable goods and

services without payment of Ohio sales tax to retailers owe

4.

Tax liability –

total amount of taxable purchases reported

use tax on those purchases. The use tax rate in your county

on line 3 multiplied by the use tax rate in effect in your

is equivalent to the sales tax rate.

county during the reporting period. Remember that the use

tax rate is equivalent to the prevailing sales tax rate in your

If you are not currently registered with Ohio for reporting

county.

consumer's use tax, you should review your purchase records

for the last year and determine if Ohio use tax is due. If use

5. If, on a regular basis, you are making taxable purchases

tax is due, please complete the voluntary use tax payment

upon which no tax is being charged, you should check the

form and submit it with payment of the amount due.

REQUEST CONSUMER'S USE TAX REGISTRATION box

or apply online at Ohio Business Gateway (obg.ohio.gov).

Please do not combine your payment of the VP USE form

with the payment of any other tax return or document.

Make your check payable to the Ohio Treasurer of State

and mail to the OHIO DEPARTMENT OF TAXATION, Sales

and Use Tax Division, P.O. Box 530, Columbus, OH 43216-

0530.

Please detach here – DO NOT USE PENCIL to complete this form.

VP USE

Rev. 11/05

Ohio Use Tax

Voluntary Payment Form

Name and address:

1 Reporting period

2 County

Do not file unless you are reporting taxable

purchases and paying use tax.

DOLLARS

C E N T S

This space for state use only

Make

remittance

Taxable

3

payable to:

,

,

.

purchases

Ohio Treasurer

of State

Mail To:

4

Tax liability

I declare under penalties of perjury that this form,

,

.

Ohio Dept.

including any accompanying schedules and state-

of Taxation

ments, has been examined by me, and to the best of

P.O. Box 530

Check box to request consumer's

my knowledge and belief is a true, correct and com-

5

Columbus, OH

plete report.

use tax registration.

43216-0530

This space for state use only

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1