Form S-244 - Certificate Of Previous Purchases

ADVERTISEMENT

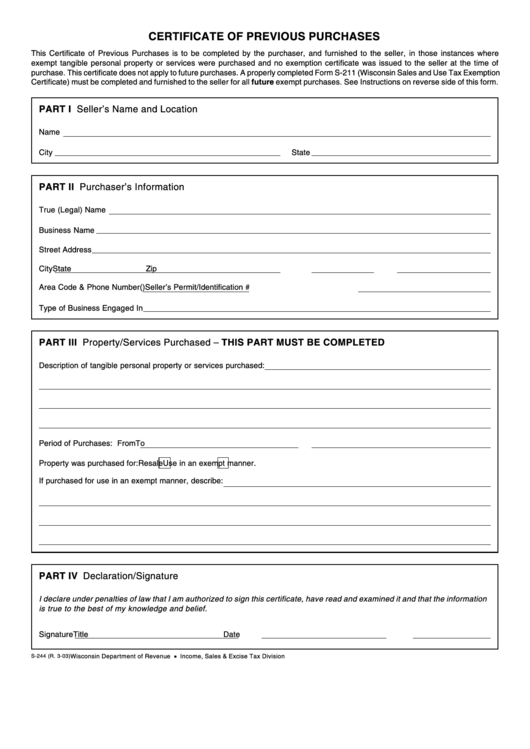

CERTIFICATE OF PREVIOUS PURCHASES

This Certificate of Previous Purchases is to be completed by the purchaser, and furnished to the seller, in those instances where

exempt tangible personal property or services were purchased and no exemption certificate was issued to the seller at the time of

purchase. This certificate does not apply to future purchases. A properly completed Form S-211 (Wisconsin Sales and Use Tax Exemption

Certificate) must be completed and furnished to the seller for all future exempt purchases. See Instructions on reverse side of this form.

PART I Seller’s Name and Location

Name

City

State

PART II Purchaser’s Information

True (Legal) Name

Business Name

Street Address

City

State

Zip

Area Code & Phone Number (

)

Seller’s Permit/Identification #

Type of Business Engaged In

PART III Property/Services Purchased – THIS PART MUST BE COMPLETED

Description of tangible personal property or services purchased:

Period of Purchases: From

To

Property was purchased for:

Resale

Use in an exempt manner.

If purchased for use in an exempt manner, describe:

PART IV Declaration/Signature

I declare under penalties of law that I am authorized to sign this certificate, have read and examined it and that the information

is true to the best of my knowledge and belief.

Signature

Title

Date

S-244 (R. 3-03)

Wisconsin Department of Revenue

•

Income, Sales & Excise Tax Division

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1