Form Op-300 - Tobacco Products Tax Return

ADVERTISEMENT

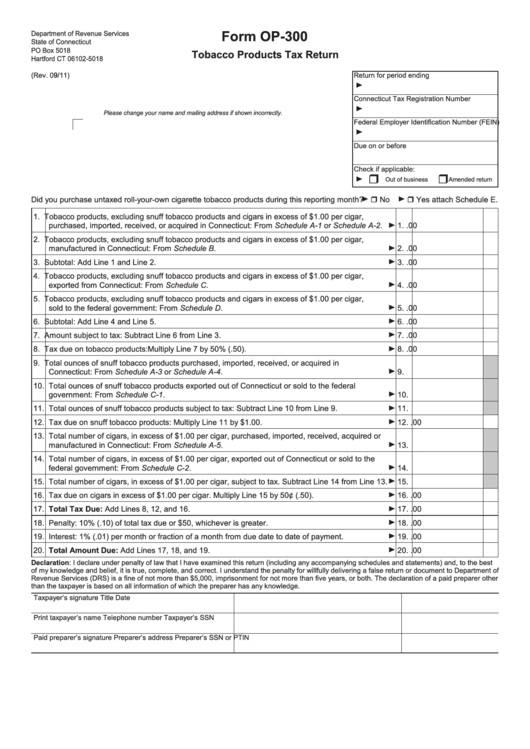

Form OP-300

Department of Revenue Services

State of Connecticut

PO Box 5018

Tobacco Products Tax Return

Hartford CT 06102-5018

(Rev. 09/11)

Return for period ending

Connecticut Tax Registration Number

Please change your name and mailing address if shown incorrectly.

Federal Employer Identification Number (FEIN)

Due on or before

Check if applicable:

Out of business

Amended return

Did you purchase untaxed roll-your-own cigarette tobacco products during this reporting month?

No

Yes attach Schedule E.

1. Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar,

purchased, imported, received, or acquired in Connecticut: From Schedule A-1 or Schedule A-2.

1.

.00

2. Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar,

manufactured in Connecticut: From Schedule B.

2.

.00

3. Subtotal: Add Line 1 and Line 2.

3.

.00

4. Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar,

exported from Connecticut: From Schedule C.

4.

.00

5. Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar,

sold to the federal government: From Schedule D.

5.

.00

6. Subtotal: Add Line 4 and Line 5.

6.

.00

7. Amount subject to tax: Subtract Line 6 from Line 3.

7.

.00

8. Tax due on tobacco products: Multiply Line 7 by 50% (.50).

8.

.00

9. Total ounces of snuff tobacco products purchased, imported, received, or acquired in

Connecticut: From Schedule A-3 or Schedule A-4.

9.

10. Total ounces of snuff tobacco products exported out of Connecticut or sold to the federal

government: From Schedule C-1.

10.

11. Total ounces of snuff tobacco products subject to tax: Subtract Line 10 from Line 9.

11.

12. Tax due on snuff tobacco products: Multiply Line 11 by $1.00.

12.

.00

13. Total number of cigars, in excess of $1.00 per cigar, purchased, imported, received, acquired or

manufactured in Connecticut: From Schedule A-5.

13.

14. Total number of cigars, in excess of $1.00 per cigar, exported out of Connecticut or sold to the

federal government: From Schedule C-2.

14.

15. Total number of cigars, in excess of $1.00 per cigar, subject to tax. Subtract Line 14 from Line 13.

15.

16. Tax due on cigars in excess of $1.00 per cigar. Multiply Line 15 by 50¢ (.50).

16.

.00

17. Total Tax Due: Add Lines 8, 12, and 16.

17.

.00

18. Penalty: 10% (.10) of total tax due or $50, whichever is greater.

18.

.00

19. Interest: 1% (.01) per month or fraction of a month from due date to date of payment.

19.

.00

20. Total Amount Due: Add Lines 17, 18, and 19.

20.

.00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to Department of

Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Print taxpayer’s name

Telephone number

Taxpayer’s SSN

Paid preparer’s signature

Preparer’s address

Preparer’s SSN or PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1