Form Dr 0229 Tobacco Products Tax Return

ADVERTISEMENT

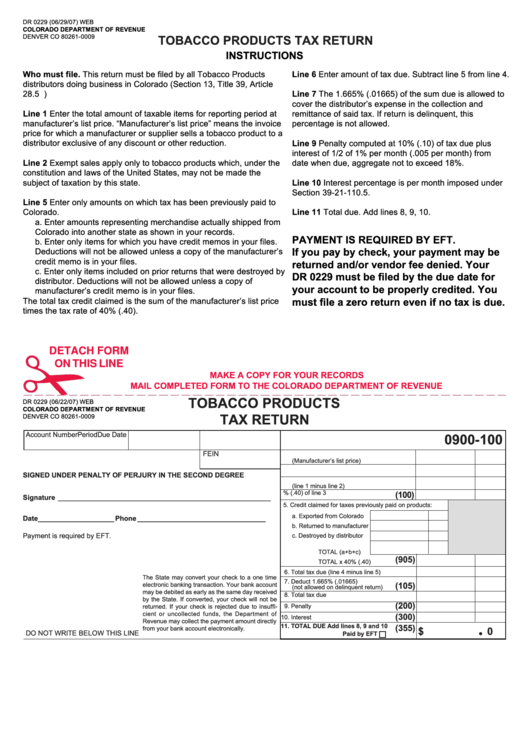

DR 0229 (06/29/07) WEB

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

TOBACCO PRODUCTS TAX RETURN

INSTRUCTIONS

Who must file. This return must be filed by all Tobacco Products

Line 6 Enter amount of tax due. Subtract line 5 from line 4.

distributors doing business in Colorado (Section 13, Title 39, Article

28.5 C.R.S.)

Line 7 The 1.665% (.01665) of the sum due is allowed to

cover the distributor’s expense in the collection and

Line 1 Enter the total amount of taxable items for reporting period at

remittance of said tax. If return is delinquent, this

manufacturer’s list price. “Manufacturer’s list price” means the invoice

percentage is not allowed.

price for which a manufacturer or supplier sells a tobacco product to a

distributor exclusive of any discount or other reduction.

Line 9 Penalty computed at 10% (.10) of tax due plus

interest of 1/2 of 1% per month (.005 per month) from

Line 2 Exempt sales apply only to tobacco products which, under the

date when due, aggregate not to exceed 18%.

constitution and laws of the United States, may not be made the

subject of taxation by this state.

Line 10 Interest percentage is per month imposed under

Section 39-21-110.5.

Line 5 Enter only amounts on which tax has been previously paid to

Colorado.

Line 11 Total due. Add lines 8, 9, 10.

a. Enter amounts representing merchandise actually shipped from

Colorado into another state as shown in your records.

PAYMENT IS REQUIRED BY EFT.

b. Enter only items for which you have credit memos in your files.

Deductions will not be allowed unless a copy of the manufacturer’s

If you pay by check, your payment may be

credit memo is in your files.

returned and/or vendor fee denied. Your

c. Enter only items included on prior returns that were destroyed by

DR 0229 must be filed by the due date for

distributor. Deductions will not be allowed unless a copy of

your account to be properly credited. You

manufacturer’s credit memo is in your files.

The total tax credit claimed is the sum of the manufacturer’s list price

must file a zero return even if no tax is due.

times the tax rate of 40% (.40).

DETACH FORM

ON THIS LINE

MAKE A COPY FOR YOUR RECORDS

MAIL COMPLETED FORM TO THE COLORADO DEPARTMENT OF REVENUE

TOBACCO PRODUCTS

DR 0229 (06/22/07) WEB

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

TAX RETURN

Account Number

Period

Due Date

0900-100

FEIN

1. Total gross purchases

(Manufacturer’s list price)

2. Exempt sales

SIGNED UNDER PENALTY OF PERJURY IN THE SECOND DEGREE

3. Taxable amount

(line 1 minus line 2)

4. Tax - 40% (.40) of line 3

(100)

Signature _____________________________________________________

5. Credit claimed for taxes previously paid on products:

a. Exported from Colorado

Date ___________________ Phone ________________________________

b. Returned to manufacturer

Payment is required by EFT.

c. Destroyed by distributor

TOTAL (a+b+c)

(905)

TOTAL x 40% (.40)

6. Total tax due (line 4 minus line 5)

The State may convert your check to a one time

7. Deduct 1.665% (.01665)

(105)

electronic banking transaction. Your bank account

(not allowed on delinquent return)

may be debited as early as the same day received

8. Total tax due

by the State. If converted, your check will not be

(200)

9. Penalty

returned. If your check is rejected due to insuffi-

cient or uncollected funds, the Department of

(300)

10. Interest

Revenue may collect the payment amount directly

11. TOTAL DUE Add lines 8, 9 and 10

(355)

from your bank account electronically.

$

00

•

DO NOT WRITE BELOW THIS LINE

Paid by EFT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1