Instructions Template For The Preparation Of The Monthly Report For Distributors

ADVERTISEMENT

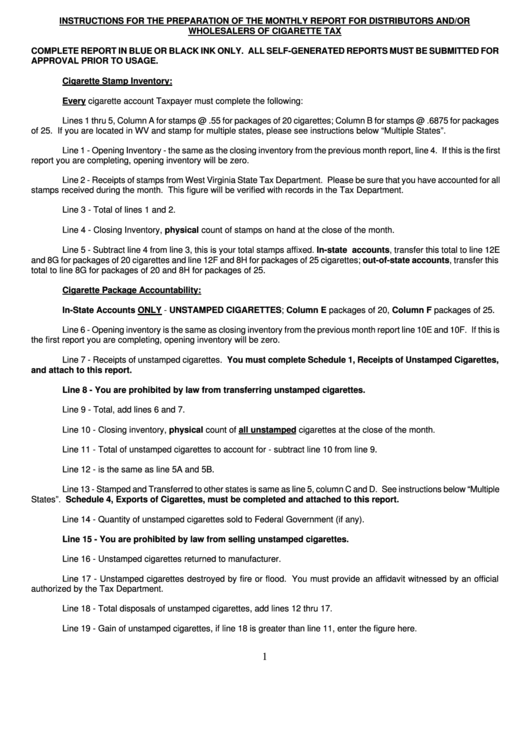

INSTRUCTIONS FOR THE PREPARATION OF THE MONTHLY REPORT FOR DISTRIBUTORS AND/OR

WHOLESALERS OF CIGARETTE TAX

COMPLETE REPORT IN BLUE OR BLACK INK ONLY. ALL SELF-GENERATED REPORTS MUST BE SUBMITTED FOR

APPROVAL PRIOR TO USAGE.

Cigarette Stamp Inventory:

Every cigarette account Taxpayer must complete the following:

Lines 1 thru 5, Column A for stamps @ .55 for packages of 20 cigarettes; Column B for stamps @ .6875 for packages

of 25. If you are located in WV and stamp for multiple states, please see instructions below “Multiple States”.

Line 1 - Opening Inventory - the same as the closing inventory from the previous month report, line 4. If this is the first

report you are completing, opening inventory will be zero.

Line 2 - Receipts of stamps from West Virginia State Tax Department. Please be sure that you have accounted for all

stamps received during the month. This figure will be verified with records in the Tax Department.

Line 3 - Total of lines 1 and 2.

Line 4 - Closing Inventory, physical count of stamps on hand at the close of the month.

Line 5 - Subtract line 4 from line 3, this is your total stamps affixed. In-state accounts, transfer this total to line 12E

and 8G for packages of 20 cigarettes and line 12F and 8H for packages of 25 cigarettes; out-of-state accounts, transfer this

total to line 8G for packages of 20 and 8H for packages of 25.

Cigarette Package Accountability:

In-State Accounts ONLY - UNSTAMPED CIGARETTES; Column E packages of 20, Column F packages of 25.

Line 6 - Opening inventory is the same as closing inventory from the previous month report line 10E and 10F. If this is

the first report you are completing, opening inventory will be zero.

Line 7 - Receipts of unstamped cigarettes. You must complete Schedule 1, Receipts of Unstamped Cigarettes,

and attach to this report.

Line 8 - You are prohibited by law from transferring unstamped cigarettes.

Line 9 - Total, add lines 6 and 7.

Line 10 - Closing inventory, physical count of all unstamped cigarettes at the close of the month.

Line 11 - Total of unstamped cigarettes to account for - subtract line 10 from line 9.

Line 12 - is the same as line 5A and 5B.

Line 13 - Stamped and Transferred to other states is same as line 5, column C and D. See instructions below “Multiple

States”. Schedule 4, Exports of Cigarettes, must be completed and attached to this report.

Line 14 - Quantity of unstamped cigarettes sold to Federal Government (if any).

Line 15 - You are prohibited by law from selling unstamped cigarettes.

Line 16 - Unstamped cigarettes returned to manufacturer.

Line 17 - Unstamped cigarettes destroyed by fire or flood. You must provide an affidavit witnessed by an official

authorized by the Tax Department.

Line 18 - Total disposals of unstamped cigarettes, add lines 12 thru 17.

Line 19 - Gain of unstamped cigarettes, if line 18 is greater than line 11, enter the figure here.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3