Hunger-Relief Food Contribution Certification Form

ADVERTISEMENT

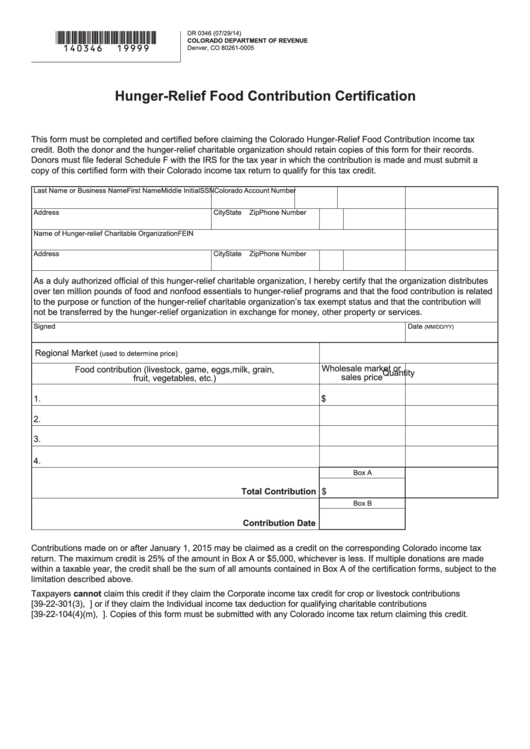

DR 0346 (07/29/14)

*140346==19999*

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Hunger-Relief Food Contribution Certification

This form must be completed and certified before claiming the Colorado Hunger-Relief Food Contribution income tax

credit. Both the donor and the hunger-relief charitable organization should retain copies of this form for their records.

Donors must file federal Schedule F with the IRS for the tax year in which the contribution is made and must submit a

copy of this certified form with their Colorado income tax return to qualify for this tax credit.

Last Name or Business Name

First Name

Middle Initial SSN

Colorado Account Number

Address

City

State

Zip

Phone Number

Name of Hunger-relief Charitable Organization

FEIN

Address

City

State

Zip

Phone Number

As a duly authorized official of this hunger-relief charitable organization, I hereby certify that the organization distributes

over ten million pounds of food and nonfood essentials to hunger-relief programs and that the food contribution is related

to the purpose or function of the hunger-relief charitable organization’s tax exempt status and that the contribution will

not be transferred by the hunger-relief organization in exchange for money, other property or services.

Signed

Date

(MM/DD/YY)

Regional Market

(used to determine price)

Wholesale market or

Food contribution (livestock, game, eggs,milk, grain,

Quantity

sales price

fruit, vegetables, etc.)

1.

$

2.

3.

4.

Box A

Total Contribution

$

Box B

Contribution Date

Contributions made on or after January 1, 2015 may be claimed as a credit on the corresponding Colorado income tax

return. The maximum credit is 25% of the amount in Box A or $5,000, whichever is less. If multiple donations are made

within a taxable year, the credit shall be the sum of all amounts contained in Box A of the certification forms, subject to the

limitation described above.

Taxpayers cannot claim this credit if they claim the Corporate income tax credit for crop or livestock contributions

[39-22-301(3), C.R.S.] or if they claim the Individual income tax deduction for qualifying charitable contributions

[39-22-104(4)(m), C.R.S.]. Copies of this form must be submitted with any Colorado income tax return claiming this credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1