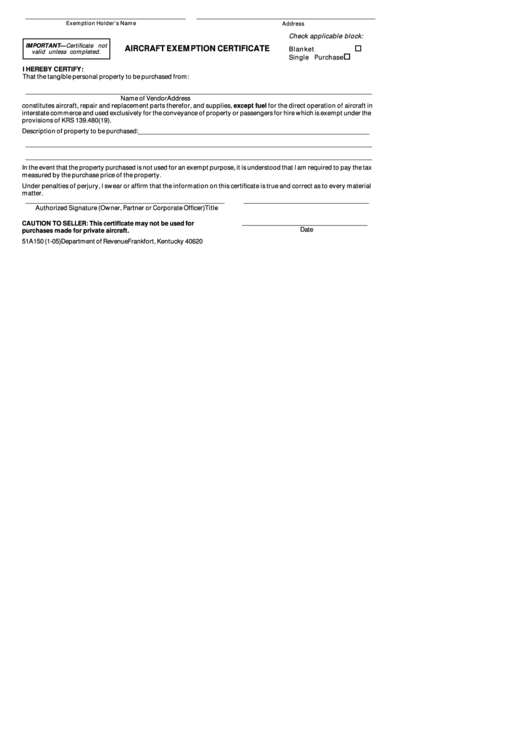

Form 51a150 - Aircraft Exemption Certificate Form

ADVERTISEMENT

___________________________________________

________________________________________________

Exemption Holder’s Name

Address

Check applicable block:

IMPORTANT — Certificate not

!

AIRCRAFT EXEMPTION CERTIFICATE

Blanket

valid unless completed.

!

Single Purchase

I HEREBY CERTIFY:

That the tangible personal property to be purchased from:

____________________________________________________________________________________________________________

Name of Vendor

Address

constitutes aircraft, repair and replacement parts therefor, and supplies, except fuel for the direct operation of aircraft in

interstate commerce and used exclusively for the conveyance of property or passengers for hire which is exempt under the

provisions of KRS 139.480(19).

Description of property to be purchased: ________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

In the event that the property purchased is not used for an exempt purpose, it is understood that I am required to pay the tax

measured by the purchase price of the property.

Under penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every material

matter.

______________________________________________________________

_______________________________________

Authorized Signature (Owner, Partner or Corporate Officer)

Title

_______________________________________

CAUTION TO SELLER: This certificate may not be used for

Date

purchases made for private aircraft.

51A150 (1-05)

Department of Revenue

Frankfort, Kentucky 40620

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1